Page 226 - KRCL ENglish

P. 226

st

Notes forming part of the Standalone Financial Statements as at 31 March, 2020

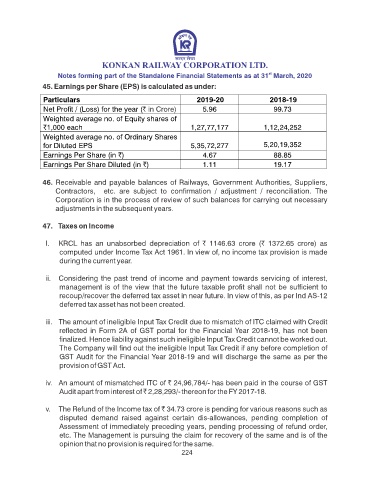

45. Earnings per Share (EPS) is calculated as under:

Particulars 2019-20 2018-19

Net Prot / (Loss) for the year (` in Crore) 5.96 99.73

Weighted average no. of Equity shares of

`1,000 each 1,27,77,177 1,12,24,252

Weighted average no. of Ordinary Shares

for Diluted EPS 5,35,72,277 5,20,19,352

Earnings Per Share (in `) 4.67 88.85

Earnings Per Share Diluted (in `) 1.11 19.17

46. Receivable and payable balances of Railways, Government Authorities, Suppliers,

Contractors, etc. are subject to conrmation / adjustment / reconciliation. The

Corporation is in the process of review of such balances for carrying out necessary

adjustments in the subsequent years.

47. Taxes on Income

I. KRCL has an unabsorbed depreciation of ` 1146.63 crore (` 1372.65 crore) as

computed under Income Tax Act 1961. In view of, no income tax provision is made

during the current year.

ii. Considering the past trend of income and payment towards servicing of interest,

management is of the view that the future taxable prot shall not be sufcient to

recoup/recover the deferred tax asset in near future. In view of this, as per Ind AS-12

deferred tax asset has not been created.

iii. The amount of ineligible Input Tax Credit due to mismatch of ITC claimed with Credit

reected in Form 2A of GST portal for the Financial Year 2018-19, has not been

nalized. Hence liability against such ineligible Input Tax Credit cannot be worked out.

The Company will nd out the ineligible Input Tax Credit if any before completion of

GST Audit for the Financial Year 2018-19 and will discharge the same as per the

provision of GST Act.

iv. An amount of mismatched ITC of ` 24,96,784/- has been paid in the course of GST

Audit apart from interest of ` 2,28,293/- thereon for the FY 2017-18.

v. The Refund of the Income tax of ` 34.73 crore is pending for various reasons such as

disputed demand raised against certain dis-allowances, pending completion of

Assessment of immediately preceding years, pending processing of refund order,

etc. The Management is pursuing the claim for recovery of the same and is of the

opinion that no provision is required for the same.

224