Page 243 - KRCL ENglish

P. 243

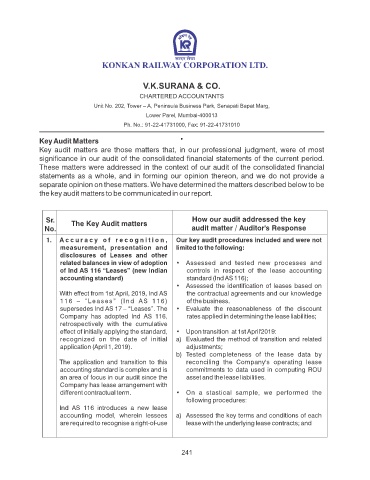

V.K.SURANA & CO.

CHARTERED ACCOUNTANTS

Unit No. 202, Tower – A, Peninsula Business Park, Senapati Bapat Marg,

Lower Parel, Mumbai-400013

Ph. No.: 91-22-41731000, Fax: 91-22-41731010

Key Audit Matters

Key audit matters are those matters that, in our professional judgment, were of most

signicance in our audit of the consolidated nancial statements of the current period.

These matters were addressed in the context of our audit of the consolidated nancial

statements as a whole, and in forming our opinion thereon, and we do not provide a

separate opinion on these matters. We have determined the matters described below to be

the key audit matters to be communicated in our report.

Sr. The Key Audit matters How our audit addressed the key

No. audit matter / Auditor's Response

1. A c c u r a c y o f r e c o g n i t i o n , Our key audit procedures included and were not

measurement, presentation and limited to the following:

disclosures of Leases and other

related balances in view of adoption • Assessed and tested new processes and

of Ind AS 116 “Leases” (new Indian controls in respect of the lease accounting

accounting standard) standard (Ind AS 116);

• Assessed the identication of leases based on

With effect from 1st April, 2019, Ind AS the contractual agreements and our knowledge

116 – “Leases” (Ind AS 116) of the business.

supersedes Ind AS 17 – “Leases”. The • Evaluate the reasonableness of the discount

Company has adopted Ind AS 116, rates applied in determining the lease liabilities;

retrospectively with the cumulative

effect of initially applying the standard, • Upon transition at 1st April'2019:

recognized on the date of initial a) Evaluated the method of transition and related

application (April 1, 2019). adjustments;

b) Tested completeness of the lease data by

The application and transition to this reconciling the Company's operating lease

accounting standard is complex and is commitments to data used in computing ROU

an area of focus in our audit since the asset and the lease liabilities.

Company has lease arrangement with

different contractual term. • On a stastical sample, we performed the

following procedures:

Ind AS 116 introduces a new lease

accounting model, wherein lessees a) Assessed the key terms and conditions of each

are required to recognise a right-of-use lease with the underlying lease contracts; and

241