Page 247 - KRCL ENglish

P. 247

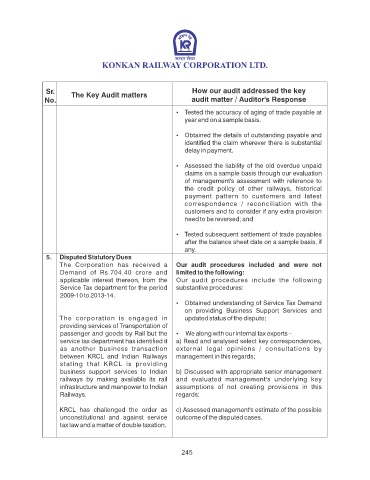

Sr. The Key Audit matters How our audit addressed the key

No. audit matter / Auditor's Response

Ÿ Tested the accuracy of aging of trade payable at

year end on a sample basis.

Ÿ Obtained the details of outstanding payable and

identied the claim wherever there is substantial

delay in payment.

Ÿ Assessed the liability of the old overdue unpaid

claims on a sample basis through our evaluation

of management's assessment with reference to

the credit policy of other railways, historical

payment pattern to customers and latest

correspondence / reconciliation with the

customers and to consider if any extra provision

need to be reversed; and

Ÿ Tested subsequent settlement of trade payables

after the balance sheet date on a sample basis, if

any.

5. Disputed Statutory Dues

The Corporation has received a Our audit procedures included and were not

Demand of Rs.704.40 crore and limited to the following:

applicable interest thereon, from the Our audit procedures include the following

Service Tax department for the period substantive procedures:

2009-10 to 2013-14.

Ÿ Obtained understanding of Service Tax Demand

on providing Business Support Services and

The corporation is engaged in updated status of the dispute;

providing services of Transportation of

passenger and goods by Rail but the Ÿ We along with our internal tax experts –

service tax department has identied it a) Read and analysed select key correspondences,

as another business transaction external legal opinions / consultations by

between KRCL and Indian Railways management in this regards;

stating that KRCL is providing

business support services to Indian b) Discussed with appropriate senior management

railways by making available its rail and evaluated management's underlying key

infrastructure and manpower to Indian assumptions of not creating provisions in this

Railways. regards;

KRCL has challenged the order as c) Assessed management's estimate of the possible

unconstitutional and against service outcome of the disputed cases.

tax law and a matter of double taxation.

245