Page 20 - Lennox International - May 2020

P. 20

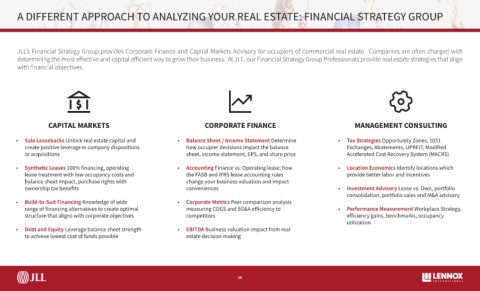

A DIFFERENT APPROACH TO ANALYZING YOUR REAL ESTATE: FINANCIAL STRATEGY GROUP

JLL’s Financial Strategy Group provides Corporate Finance and Capital Markets Advisory for occupiers of commercial real estate. Companies are often charged with

determining the most effective and capital efficient way to grow their business. At JLL, our Financial Strategy Group Professionals provide real estate strategies that align

with financial objectives.

CAPITAL MARKETS CORPORATE FINANCE MANAGEMENT CONSULTING

• Sale Leasebacks Unlock real estate capital and • Balance Sheet / Income Statement Determine • Tax Strategies Opportunity Zones, 1031

create positive leverage in company dispositions how occupier decisions impact the balance Exchanges, Abatements, UPREIT, Modified

or acquisitions sheet, income statement, EPS, and share price Accelerated Cost Recovery System (MACRS)

• Synthetic Leases 100% financing, operating • Accounting Finance vs. Operating lease; how • Location Economics Identify locations which

lease treatment with low occupancy costs and the FASB and IFRS lease accounting rules provide better labor and incentives

balance sheet impact, purchase rights with change your business valuation and impact

ownership tax benefits conveniences • Investment Advisory Lease vs. Own, portfolio

consolidation, portfolio sales and M&A advisory

• Build-to-Suit Financing Knowledge of wide • Corporate Metrics Peer comparison analysis

range of financing alternatives to create optimal measuring COGS and SG&A efficiency to • Performance Measurement Workplace Strategy,

structure that aligns with corporate objectives competitors efficiency gains, benchmarks, occupancy

utilization

• Debt and Equity Leverage balance sheet strength • EBITDA Business valuation impact from real

to achieve lowest cost of funds possible estate decision making

19