Page 21 - Lennox International - May 2020

P. 21

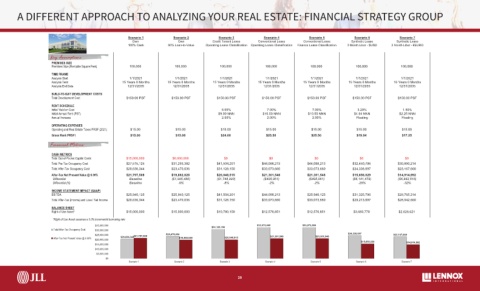

A DIFFERENT APPROACH TO ANALYZING YOUR REAL ESTATE: FINANCIAL STRATEGY GROUP

Executive Summary

Analysis as of 1/1/2021 Scenario 1 Scenario 2 Scenario 3 Scenario 4 Scenario 5 Scenario 6 Scenario 7

Own Own Credit Tenant Lease Conventional Lease Conventional Lease Synthetic Lease Synthetic Lease

100% Cash 60% Loan-to-Value Operating Lease Classification Operating Lease Classification Finance Lease Classification 3 Month Libor - $USD 3 Month Libor - €EURO

Key Assumptions

PREMISES SIZE

Premises Size (Rentable Square Feet) 100,000 100,000 100,000 100,000 100,000 100,000 100,000

TIME FRAME

Analysis Start 1/1/2021 1/1/2021 1/1/2021 1/1/2021 1/1/2021 1/1/2021 1/1/2021

Analysis Term 15 Years 0 Months 15 Years 0 Months 15 Years 0 Months 15 Years 0 Months 15 Years 0 Months 15 Years 0 Months 15 Years 0 Months

Analysis End Date 12/31/2035 12/31/2035 12/31/2035 12/31/2035 12/31/2035 12/31/2035 12/31/2035

BUILD-TO-SUIT DEVELOPMENT COSTS

Total Development Cost $150.00 PSF $150.00 PSF $150.00 PSF $150.00 PSF $150.00 PSF $150.00 PSF $150.00 PSF

RENT SCHEDULE

Initial Yield on Cost 6.00% 7.00% 7.00% 3.29% 1.50%

Initial Annual Rent (PSF) $0.00 NNN $0.00 NNN $9.00 NNN $10.50 NNN $10.50 NNN $4.94 NNN $2.25 NNN

Annual Increase $0.00 PSF $0.00 PSF 2.00% 2.00% 2.00% Floating Floating

OPERATING EXPENSES

Operating and Real Estate Taxes PRSF (2021) $15.00 $15.00 $15.00 $15.00 $15.00 $15.00 $15.00

Gross Rent (PRSF) $15.00 $15.00 $24.00 $25.50 $25.50 $19.94 $17.25

Financial Metrics

CASH METRICS

Total Out-of-Pocket Capital Costs $15,000,000 $6,000,000 $0 $0 $0 $0 $0

Total Pre-Tax Occupancy Cost $27,515,125 $31,293,382 $41,504,201 $44,098,213 $44,098,213 $32,450,796 $30,890,214

Total After-Tax Occupancy Cost $20,636,344 $23,470,036 $31,128,150 $33,073,660 $33,073,660 $24,338,097 $23,167,660

After-Tax Net Present Value @ 6.00% $21,797,508 $19,802,028 $20,048,515 $21,301,548 $21,301,548 $15,656,029 $14,914,992

Differential Baseline ($1,995,480) ($1,748,993) ($495,961) ($495,961) ($6,141,479) ($6,882,516)

Differential (%) Baseline -9% -8% -2% -2% -28% -32%

INCOME STATEMENT IMPACT (GAAP)

EBITDA $25,940,125 $25,940,125 $41,504,201 $44,098,213 $25,940,125 $31,325,796 $29,765,214

Total After-Tax (Income) and Loss / Net Income $20,636,344 $23,470,036 $31,128,150 $33,073,660 $33,073,660 $29,213,097 $28,042,660

BALANCE SHEET

Right of Use Asset* $15,000,000 $15,000,000 $10,780,158 $12,576,851 $12,576,851 $3,693,770 $2,626,621

*Right of Use Asset assumes a 5.0% incremental borrowing rate

$35,000,000 $31,128,150 $33,073,660 $33,073,660

Total After-Tax Occupancy Cost $30,000,000

$25,000,000 $21,797,508 $23,470,036 $21,301,548 $21,301,548 $24,338,097 $23,167,660

After-Tax Net Present Value @ 6.00% $20,636,344 $19,802,028 $20,048,515

$20,000,000

$15,656,029 $14,914,992

$15,000,000

$10,000,000

$5,000,000

$0

Scenario 1 Scenario 2 Scenario 3 Scenario 4 Scenario 5 Scenario 6 Scenario 7

Page 1

5/19/2020 JLL Financial Strategy Group This page is subject to the disclaimer found on the Table of Contents

20