Page 30 - DBP5043

P. 30

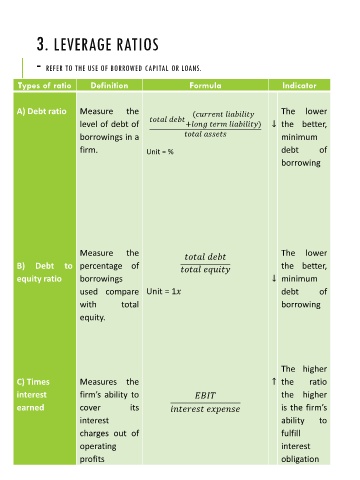

3. LEVERAGE RATIOS

- REFER TO THE USE OF BORROWED CAPITAL OR LOANS.

Types of ratio Definition Formula Indicator

A) Debt ratio Measure the ( The lower

level of debt of + ) ↓ the better,

borrowings in a minimum

firm. Unit = % debt of

borrowing

Measure the The lower

B) Debt to percentage of the better,

equity ratio borrowings ↓ minimum

used compare Unit = 1 debt of

with total borrowing

equity.

The higher

C) Times Measures the ↑ the ratio

interest firm’s ability to the higher

earned cover its is the firm’s

interest ability to

charges out of fulfill

operating interest

profits obligation