Page 31 - DBP5043

P. 31

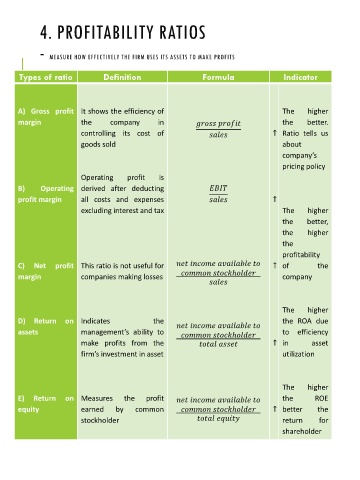

4. PROFITABILITY RATIOS

- MEASURE HOW EFFECTIVELY THE FIRM USES ITS ASSETS TO MAKE PROFITS

Types of ratio Definition Formula Indicator

A) Gross profit It shows the efficiency of The higher

margin the company in the better.

controlling its cost of ↑ Ratio tells us

goods sold about

company’s

pricing policy

Operating profit is

B) Operating derived after deducting

profit margin all costs and expenses ↑

excluding interest and tax The higher

the better,

the higher

the

profitability

C) Net profit This ratio is not useful for ↑ of the

ℎ

margin companies making losses company

The higher

D) Return on Indicates the the ROA due

assets management’s ability to ℎ to efficiency

make profits from the ↑ in asset

firm’s investment in asset utilization

The higher

E) Return on Measures the profit the ROE

equity earned by common ℎ ↑ better the

stockholder return for

shareholder