Page 76 - DBP5043

P. 76

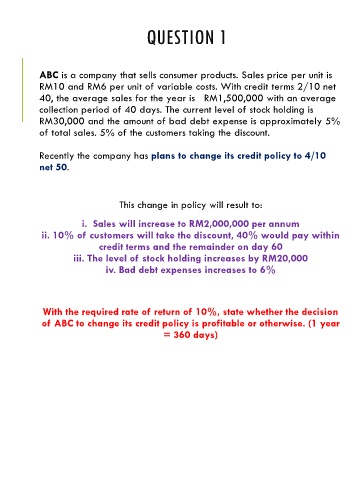

QUESTION 1

ABC is a company that sells consumer products. Sales price per unit is

RM10 and RM6 per unit of variable costs. With credit terms 2/10 net

40, the average sales for the year is RM1,500,000 with an average

collection period of 40 days. The current level of stock holding is

RM30,000 and the amount of bad debt expense is approximately 5%

of total sales. 5% of the customers taking the discount.

Recently the company has plans to change its credit policy to 4/10

net 50.

This change in policy will result to:

i. Sales will increase to RM2,000,000 per annum

ii. 10% of customers will take the discount, 40% would pay within

credit terms and the remainder on day 60

iii. The level of stock holding increases by RM20,000

iv. Bad debt expenses increases to 6%

With the required rate of return of 10%, state whether the decision

of ABC to change its credit policy is profitable or otherwise. (1 year

= 360 days)