Page 74 - DBP5043

P. 74

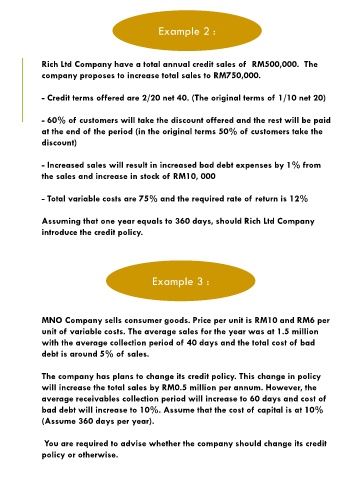

Example 2 :

Rich Ltd Company have a total annual credit sales of RM500,000. The

company proposes to increase total sales to RM750,000.

- Credit terms offered are 2/20 net 40. (The original terms of 1/10 net 20)

- 60% of customers will take the discount offered and the rest will be paid

at the end of the period (in the original terms 50% of customers take the

discount)

- Increased sales will result in increased bad debt expenses by 1% from

the sales and increase in stock of RM10, 000

- Total variable costs are 75% and the required rate of return is 12%

Assuming that one year equals to 360 days, should Rich Ltd Company

introduce the credit policy.

Example 3 :

MNO Company sells consumer goods. Price per unit is RM10 and RM6 per

unit of variable costs. The average sales for the year was at 1.5 million

with the average collection period of 40 days and the total cost of bad

debt is around 5% of sales.

The company has plans to change its credit policy. This change in policy

will increase the total sales by RM0.5 million per annum. However, the

average receivables collection period will increase to 60 days and cost of

bad debt will increase to 10%. Assume that the cost of capital is at 10%

(Assume 360 days per year).

You are required to advise whether the company should change its credit

policy or otherwise.