Page 70 - DBP5043

P. 70

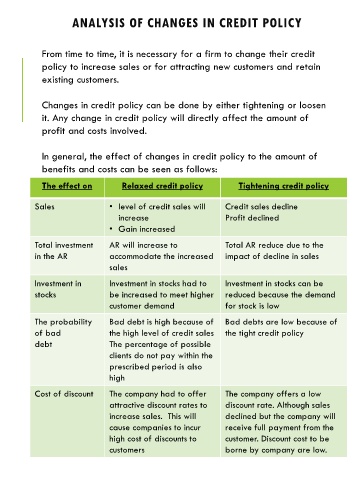

ANALYSIS OF CHANGES IN CREDIT POLICY

From time to time, it is necessary for a firm to change their credit

policy to increase sales or for attracting new customers and retain

existing customers.

Changes in credit policy can be done by either tightening or loosen

it. Any change in credit policy will directly affect the amount of

profit and costs involved.

In general, the effect of changes in credit policy to the amount of

benefits and costs can be seen as follows:

The effect on Relaxed credit policy Tightening credit policy

Sales • level of credit sales will Credit sales decline

increase Profit declined

• Gain increased

Total investment AR will increase to Total AR reduce due to the

in the AR accommodate the increased impact of decline in sales

sales

Investment in Investment in stocks had to Investment in stocks can be

stocks be increased to meet higher reduced because the demand

customer demand for stock is low

The probability Bad debt is high because of Bad debts are low because of

of bad the high level of credit sales the tight credit policy

debt The percentage of possible

clients do not pay within the

prescribed period is also

high

Cost of discount The company had to offer The company offers a low

attractive discount rates to discount rate. Although sales

increase sales. This will declined but the company will

cause companies to incur receive full payment from the

high cost of discounts to customer. Discount cost to be

customers borne by company are low.