Page 73 - DBP5043

P. 73

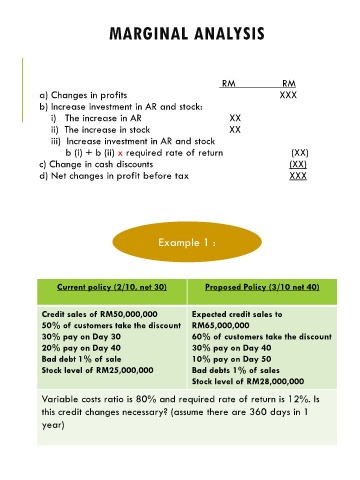

MARGINAL ANALYSIS

RM RM

a) Changes in profits XXX

b) Increase investment in AR and stock:

i) The increase in AR XX

ii) The increase in stock XX

iii) Increase investment in AR and stock

b (i) + b (ii) x required rate of return (XX)

c) Change in cash discounts (XX)

d) Net changes in profit before tax XXX

Example 1 :

Current policy (2/10, net 30) Proposed Policy (3/10 net 40)

Credit sales of RM50,000,000 Expected credit sales to

50% of customers take the discount RM65,000,000

30% pay on Day 30 60% of customers take the discount

20% pay on Day 40 30% pay on Day 40

Bad debt 1% of sale 10% pay on Day 50

Stock level of RM25,000,000 Bad debts 1% of sales

Stock level of RM28,000,000

Variable costs ratio is 80% and required rate of return is 12%. Is

this credit changes necessary? (assume there are 360 days in 1

year)