Page 66 - DBP5043

P. 66

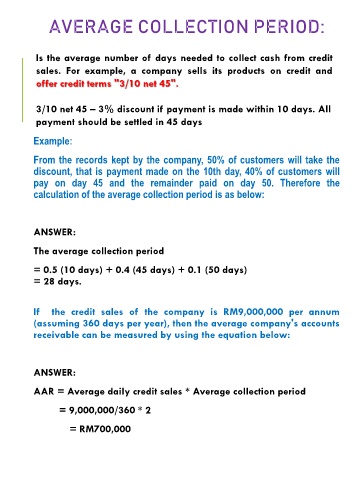

AVERAGE COLLECTION PERIOD:

Is the average number of days needed to collect cash from credit

sales. For example, a company sells its products on credit and

offer credit terms "3/10 net 45".

3/10 net 45 – 3% discount if payment is made within 10 days. All

payment should be settled in 45 days

Example:

From the records kept by the company, 50% of customers will take the

discount, that is payment made on the 10th day, 40% of customers will

pay on day 45 and the remainder paid on day 50. Therefore the

calculation of the average collection period is as below:

ANSWER:

The average collection period

= 0.5 (10 days) + 0.4 (45 days) + 0.1 (50 days)

= 28 days.

If the credit sales of the company is RM9,000,000 per annum

(assuming 360 days per year), then the average company's accounts

receivable can be measured by using the equation below:

ANSWER:

AAR = Average daily credit sales * Average collection period

= 9,000,000/360 * 2

= RM700,000