Page 382 - Krugmans Economics for AP Text Book_Neat

P. 382

figure 34.7

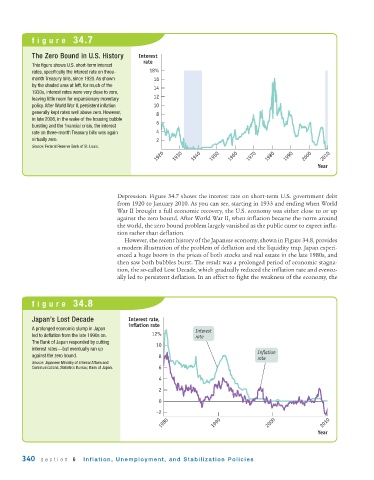

The Zero Bound in U.S. History Interest

rate

This figure shows U.S. short - term interest

rates, specifically the interest rate on three - 18%

month Treasury bills, since 1920. As shown 16

by the shaded area at left, for much of the 14

1930s, interest rates were very close to zero,

leaving little room for expansionary monetary 12

policy. After World War II, persistent inflation 10

generally kept rates well above zero. However, 8

in late 2008, in the wake of the housing bubble 6

bursting and the financial crisis, the interest

rate on three-month Treasury bills was again 4

virtually zero. 2

Source: Federal Reserve Bank of St. Louis.

1920 1930 1940 1950 1960 1970 1980 1990 2000 2010

Year

Depression. Figure 34.7 shows the interest rate on short-term U.S. government debt

from 1920 to January 2010. As you can see, starting in 1933 and ending when World

War II brought a full economic recovery, the U.S. economy was either close to or up

against the zero bound. After World War II, when inflation became the norm around

the world, the zero bound problem largely vanished as the public came to expect infla-

tion rather than deflation.

However, the recent history of the Japanese economy, shown in Figure 34.8, provides

a modern illustration of the problem of deflation and the liquidity trap. Japan experi-

enced a huge boom in the prices of both stocks and real estate in the late 1980s, and

then saw both bubbles burst. The result was a prolonged period of economic stagna-

tion, the so-called Lost Decade, which gradually reduced the inflation rate and eventu-

ally led to persistent deflation. In an effort to fight the weakness of the economy, the

figure 34.8

Japan’s Lost Decade Interest rate,

inflation rate

A prolonged economic slump in Japan Interest

led to deflation from the late 1990s on. 12% rate

The Bank of Japan responded by cutting 10

interest rates—but eventually ran up

against the zero bound. 8 Inflation

rate

Source: Japanese Ministry of Internal Affairs and

Communications, Statistics Bureau; Bank of Japan. 6

4

2

0

–2

1980 1990 2000 2010

Year

340 section 6 Inflation, Unemployment, and Stabilization Policies