Page 46 - NEW Employee Handbook June 15, 2025

P. 46

ACCRUAL AND PAYMENT OF PTO

Accruals are based upon paid hours up to 2,080 hours per year, excluding overtime.

Length of service determines the rate at which the employee will accrue PTO.

Employees become eligible for the higher accrual rate on the first day of the pay period

in which the employee’s anniversary date falls.

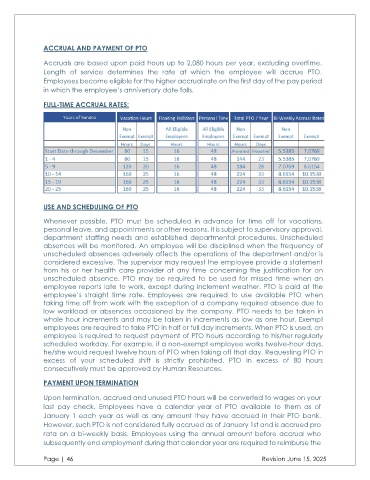

FULL-TIME ACCRUAL RATES:

USE AND SCHEDULING OF PTO

Whenever possible, PTO must be scheduled in advance for time off for vacations,

personal leave, and appointments or other reasons. It is subject to supervisory approval,

department staffing needs and established departmental procedures. Unscheduled

absences will be monitored. An employee will be disciplined when the frequency of

unscheduled absences adversely affects the operations of the department and/or is

considered excessive. The supervisor may request the employee provide a statement

from his or her health care provider at any time concerning the justification for an

unscheduled absence. PTO may be required to be used for missed time when an

employee reports late to work, except during inclement weather. PTO is paid at the

employee’s straight time rate. Employees are required to use available PTO when

taking time off from work with the exception of a company required absence due to

low workload or absences occasioned by the company. PTO needs to be taken in

whole hour increments and may be taken in increments as low as one hour. Exempt

employees are required to take PTO in half or full day increments. When PTO is used, an

employee is required to request payment of PTO hours according to his/her regularly

scheduled workday. For example, if a non-exempt employee works twelve-hour days,

he/she would request twelve hours of PTO when taking off that day. Requesting PTO in

excess of your scheduled shift is strictly prohibited. PTO in excess of 80 hours

consecutively must be approved by Human Resources.

PAYMENT UPON TERMINATION

Upon termination, accrued and unused PTO hours will be converted to wages on your

last pay check. Employees have a calendar year of PTO available to them as of

January 1 each year as well as any amount they have accrued in their PTO bank.

However, such PTO is not considered fully accrued as of January 1st and is accrued pro

rata on a bi-weekly basis. Employees using the annual amount before accrual who

subsequently end employment during that calendar year are required to reimburse the

Page | 46 Revision June 15, 2025