Page 50 - UUBO PE Summit 2020 - Materials

P. 50

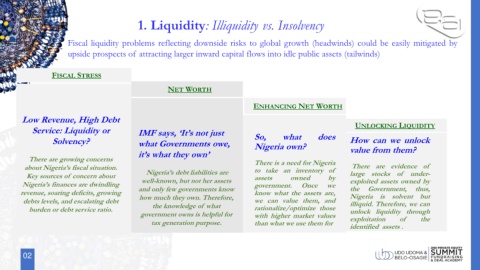

1. Liquidity: Illiquidity vs. Insolvency

Fiscal liquidity problems reflecting downside risks to global growth (headwinds) could be easily mitigated by

upside prospects of attracting larger inward capital flows into idle public assets (tailwinds)

FISCAL STRESS

NET WORTH

ENHANCING NET WORTH

Low Revenue, High Debt

Service: Liquidity or IMF says, ‘It’s not just UNLOCKING LIQUIDITY

Solvency? what Governments owe, So, what does How can we unlock

Nigeria own?

it’s what they own’ value from them?

There are growing concerns There is a need for Nigeria

about Nigeria’s fiscal situation. to take an inventory of There are evidence of

Key sources of concern about Nigeria’s debt liabilities are assets owned by large stocks of under-

Nigeria’s finances are dwindling well-known, but not her assets government. Once we exploited assets owned by

revenue, soaring deficits, growing and only few governments know know what the assets are, the Government, thus,

Nigeria is solvent but

debts levels, and escalating debt how much they own. Therefore, we can value them, and illiquid. Therefore, we can

burden or debt service ratio. the knowledge of what rationalize/optimize those unlock liquidity through

government owns is helpful for with higher market values

tax generation purpose. than what we use them for exploitation of the

identified assets .

02 3