Page 52 - UUBO PE Summit 2020 - Materials

P. 52

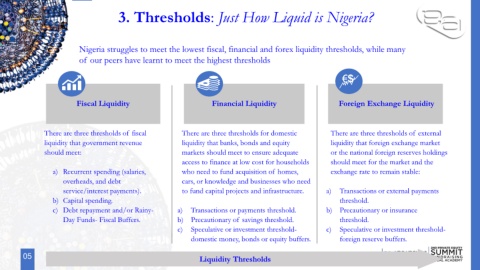

3. Thresholds: Just How Liquid is Nigeria?

Nigeria struggles to meet the lowest fiscal, financial and forex liquidity thresholds, while many

of our peers have learnt to meet the highest thresholds

Fiscal Liquidity Financial Liquidity Foreign Exchange Liquidity

There are three thresholds of fiscal There are three thresholds for domestic There are three thresholds of external

liquidity that government revenue liquidity that banks, bonds and equity liquidity that foreign exchange market

should meet: markets should meet to ensure adequate or the national foreign reserves holdings

access to finance at low cost for households should meet for the market and the

a) Recurrent spending (salaries, who need to fund acquisition of homes, exchange rate to remain stable:

overheads, and debt cars, or knowledge and businesses who need

service/interest payments). to fund capital projects and infrastructure. a) Transactions or external payments

b) Capital spending. threshold.

c) Debt repayment and/or Rainy- a) Transactions or payments threshold. b) Precautionary or insurance

Day Funds- Fiscal Buffers. b) Precautionary of savings threshold. threshold.

c) Speculative or investment threshold- c) Speculative or investment threshold-

domestic money, bonds or equity buffers. foreign reserve buffers.

05 Liquidity Thresholds 5