Page 50 - UUBO Deal Academy 2020 - Materials

P. 50

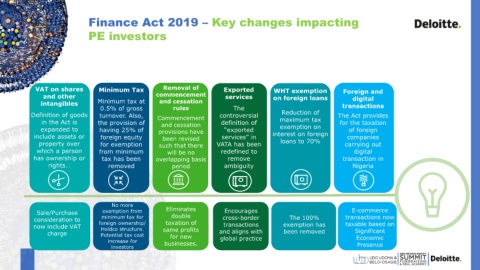

Finance Act 2019 – Key changes impacting

PE investors

VAT on shares Minimum Tax Removal of Exported WHT exemption Foreign and

and other commencement services on foreign loans digital

intangibles Minimum tax at and cessation transactions

0.5% of gross rules The

Definition of goods turnover. Also, Commencement controversial Reduction of The Act provides

in the Act is the provision of and cessation definition of maximum tax for the taxation

expanded to having 25% of provisions have “exported exemption on of foreign

include assets or foreign equity been revised services” in interest on foreign companies

property over for exemption such that there VATA has been loans to 70% carrying out

which a person from minimum will be no redefined to digital

has ownership or tax has been overlapping basis remove transaction in

rights… removed period ambiguity Nigeria

No more

Sale/Purchase exemption from Eliminates Encourages E-commerce

double

consideration to minimum tax for taxation of cross-border The 100% transactions now

now include VAT foreign ownership/ same profits transactions exemption has taxable based on

Holdco structure.

charge Potential tax cost for new and aligns with been removed Significant

increase for businesses. global practice Economic

investors Presence

01