Page 49 - UUBO Deal Academy 2020 - Materials

P. 49

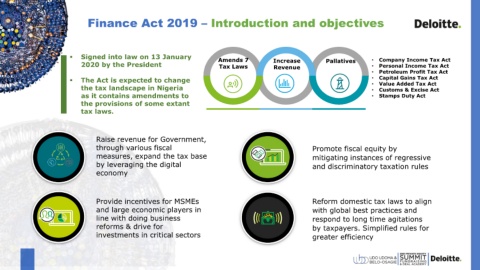

Finance Act 2019 – Introduction and objectives

Signed into law on 13 January Amends 7 • Company Income Tax Act

2020 by the President Tax Laws Increase Pallatives • Personal Income Tax Act

Revenue

• Petroleum Profit Tax Act

The Act is expected to change • • Capital Gains Tax Act

Value Added Tax Act

the tax landscape in Nigeria • Customs & Excise Act

as it contains amendments to • Stamps Duty Act

the provisions of some extant

tax laws.

Raise revenue for Government,

through various fiscal Promote fiscal equity by

measures, expand the tax base mitigating instances of regressive

by leveraging the digital and discriminatory taxation rules

economy

Provide incentives for MSMEs Reform domestic tax laws to align

and large economic players in with global best practices and

% line with doing business respond to long time agitations

reforms & drive for by taxpayers. Simplified rules for

investments in critical sectors greater efficiency

01