Page 44 - UUBO Deal Academy 2020 - Materials

P. 44

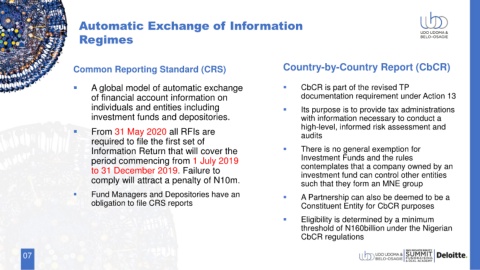

Automatic Exchange of Information

Regimes

Common Reporting Standard (CRS) Country-by-Country Report (CbCR)

▪ A global model of automatic exchange ▪ CbCR is part of the revised TP

of financial account information on documentation requirement under Action 13

individuals and entities including ▪ Its purpose is to provide tax administrations

investment funds and depositories. with information necessary to conduct a

high-level, informed risk assessment and

▪ From 31 May 2020 all RFIs are audits

required to file the first set of

Information Return that will cover the ▪ There is no general exemption for

period commencing from 1 July 2019 Investment Funds and the rules

to 31 December 2019. Failure to contemplates that a company owned by an

investment fund can control other entities

comply will attract a penalty of N10m. such that they form an MNE group

▪ Fund Managers and Depositories have an ▪ A Partnership can also be deemed to be a

obligation to file CRS reports Constituent Entity for CbCR purposes

▪ Eligibility is determined by a minimum

threshold of N160billion under the Nigerian

CbCR regulations

07