Page 39 - UUBO Deal Academy 2020 - Materials

P. 39

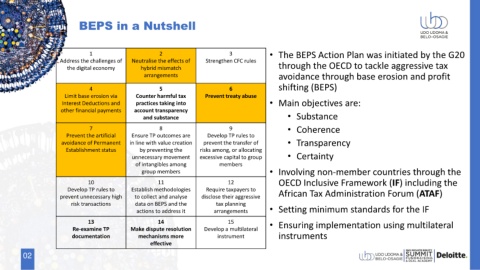

BEPS in a Nutshell

1 2 3 • The BEPS Action Plan was initiated by the G20

Address the challenges of Neutralise the effects of Strengthen CFC rules

the digital economy hybrid mismatch through the OECD to tackle aggressive tax

arrangements avoidance through base erosion and profit

4 5 6 shifting (BEPS)

Limit base erosion via Counter harmful tax Prevent treaty abuse

Interest Deductions and practices taking into • Main objectives are:

other financial payments account transparency

and substance • Substance

7 8 9 • Coherence

Prevent the artificial Ensure TP outcomes are Develop TP rules to

avoidance of Permanent in line with value creation prevent the transfer of • Transparency

Establishment status by preventing the risks among, or allocating

unnecessary movement excessive capital to group • Certainty

of intangibles among members

group members • Involving non-member countries through the

10 11 12 OECD Inclusive Framework (IF) including the

Develop TP rules to Establish methodologies Require taxpayers to

prevent unnecessary high to collect and analyse disclose their aggressive African Tax Administration Forum (ATAF)

risk transactions data on BEPS and the tax planning

actions to address it arrangements • Setting minimum standards for the IF

13 14 15

Re-examine TP Make dispute resolution Develop a multilateral • Ensuring implementation using multilateral

documentation mechanisms more instrument instruments

effective

02