Page 40 - UUBO Deal Academy 2020 - Materials

P. 40

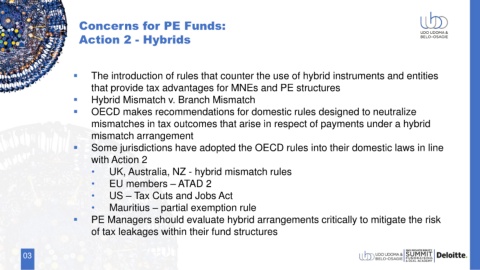

Concerns for PE Funds:

Action 2 - Hybrids

▪ The introduction of rules that counter the use of hybrid instruments and entities

that provide tax advantages for MNEs and PE structures

▪ Hybrid Mismatch v. Branch Mismatch

▪ OECD makes recommendations for domestic rules designed to neutralize

mismatches in tax outcomes that arise in respect of payments under a hybrid

mismatch arrangement

▪ Some jurisdictions have adopted the OECD rules into their domestic laws in line

with Action 2

• UK, Australia, NZ - hybrid mismatch rules

• EU members – ATAD 2

• US – Tax Cuts and Jobs Act

• Mauritius – partial exemption rule

▪ PE Managers should evaluate hybrid arrangements critically to mitigate the risk

of tax leakages within their fund structures

03