Page 51 - UUBO Deal Academy 2020 - Materials

P. 51

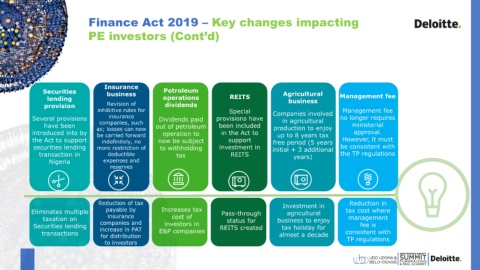

Finance Act 2019 – Key changes impacting

PE investors (Cont’d)

Insurance

Securities business Petroleum Agricultural

lending operations REITS business Management fee

provision Revision of dividends

inhibitive rules for Special Companies involved Management fee

Several provisions insurance Dividends paid provisions have in agricultural no longer requires

have been companies, such out of petroleum been included production to enjoy ministerial

introduced into by as; losses can now operation to in the Act to up to 8 years tax approval.

be carried forward

the Act to support indefinitely, no now be subject support free period (5 years However, it must

securities lending more restriction of to withholding investment in initial + 3 additional be consistent with

transaction in deductible tax REITS years) the TP regulations

Nigeria expenses and

reserves

Reduction of tax Investment in Reduction in

Eliminates multiple payable by Increases tax Pass-through agricultural tax cost where

taxation on insurance cost of status for business to enjoy management

companies and

Securities lending increase in PAT investors in REITS created tax holiday for fee is

transactions for distribution E&P companies almost a decade consistent with

to investors TP regulations

01