Page 52 - UUBO Deal Academy 2020 - Materials

P. 52

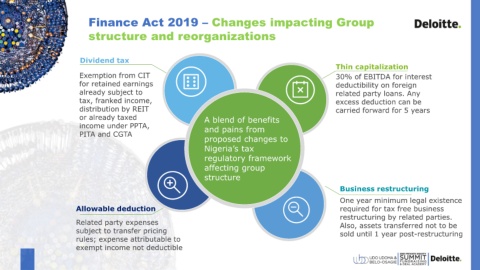

Finance Act 2019 – Changes impacting Group

structure and reorganizations

Dividend tax

Thin capitalization

Exemption from CIT 30% of EBITDA for interest

for retained earnings deductibility on foreign

already subject to related party loans. Any

tax, franked income, excess deduction can be

distribution by REIT carried forward for 5 years

or already taxed A blend of benefits

income under PPTA, and pains from

PITA and CGTA

proposed changes to

Nigeria’s tax

regulatory framework

affecting group

structure

Business restructuring

One year minimum legal existence

Allowable deduction required for tax free business

restructuring by related parties.

Related party expenses Also, assets transferred not to be

subject to transfer pricing sold until 1 year post-restructuring

rules; expense attributable to

exempt income not deductible

01