Page 52 - CAPE Financial Services Syllabus Macmillan_Neat

P. 52

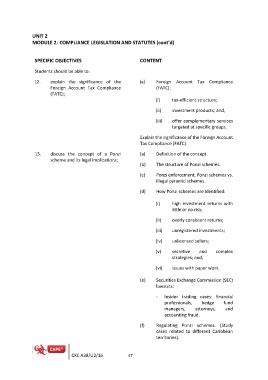

UNIT 2

MODULE 2: COMPLIANCE LEGISLATION AND STATUTES (cont’d)

SPECIFIC OBJECTIVES CONTENT

Students should be able to:

12. explain the significance of the (a) Foreign Account Tax Compliance

(FATC):

Foreign Account Tax Compliance

(FATC); (i) tax-efficient structure;

13. discuss the concept of a Ponzi (ii) investment products; and,

scheme and its legal implications;

(iii) offer complementary services

targeted at specific groups.

Explain the significance of the Foreign Account

Tax Compliance (FATC).

(a) Definition of the concept.

(b) The structure of Ponzi schemes.

(c) Ponzi enforcement, Ponzi schemes vs.

illegal pyramid schemes.

(d) How Ponzi schemes are identified:

(i) high investment returns with

little or no risk;

(ii) overly consistent returns;

(iii) unregistered investments;

(iv) unlicensed sellers;

(v) secretive and complex

strategies; and,

(vi) issues with paper work.

(e) Securities Exchange Commission (SEC)

lawsuits:

- Insider trading cases: financial

professionals, hedge fund

managers, attorneys, and

accounting fraud.

(f) Regulating Ponzi schemes. (Study

cases related to different Caribbean

territories).

CXC A38/U2/16 47