Page 287 - Records of Bahrain (7) (ii)_Neat

P. 287

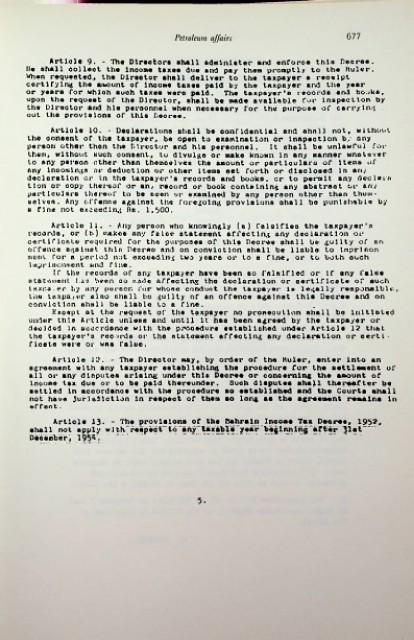

Petroleum affairs 677

Article 9. - The Dlrsotors shall admlnlcter and enforoe this Deeres.

Ils shall oolleot the lnoome taxes duo and pay then promptly to tho Ruler,

When requeotsd, the Director shall deliver to the taxpayer a receipt

certifying the aiwount of Income taxes paid by the taxpayer and the year

or years for whloh suoh taxes Mere paid. The taxpayer's reoorde end bo.>ks,

upon tho request of the Director, ehall be made available for Inspection by

the Director and his psrsonnel when necessary for the purpose of carrying

out the provlalona of this Deoree.

Article 10, - Deolaretlona shell be confidential and shall not, without

the consent of the taxpayer, be open to examination or Inspection by any

person other than the Director and hla personnel. It shall be unlawful for

them, without such consent, to divulge or make known In any manner wnoUver

to any person ether than themselves the amount or particulars of Items of

any lnoomin&s or deduction or other Items eet forth or dlsolosed in an/

declaration or In the taxpayer's records and books, cr to permit any dec lent

tlon or copy thereof or an» record or book containing any abatreot or any

particulars thereof to be ooen or examined by any person other than them

selves. Any offence against the foregoing provlalona ohall be punishable by

u fine not exceeding Ra. 1,500.

Articlo 11. - Any person who knowingly (a) falsifies the taxpayer's

records, or (b) wakes any false ntatement affecting any declaration or

certificate required for the purposes of this Decree shall be guilty of an

offence against thin Decree and on conviction ehall be liable to Imprison

merit, for a period not exceeding two ycaro or to « fine, or to both ouch

lioprlnoivnent and fine.

If the records of any taxpayer have been ao falsified or If any false

statement Lag been so n.ade affecting tho declaration or certificate of such

taxpayer by itny purser, for whoso conduct the taxpayer la legally reaponaiblt.,

toe taxpn/or also shall bo guilty or an offence against this Decree and on

convlation shall be liable to a fine.

Kxoepl at the request of the taxpayer no proneaullon ehall be Initiated

under this Articlo unless and until It haa been agreed by the taxpayer or

decided In accordance with the procedure established under Article 1? that

tho taxpayer's reoorde or tho ntalcaent affecting any declaration or certi

ficate were or was false.

Artlole 11?. - The Director may, by order of the Ruler, enter into an

agreement with any taxpayer establishing the procedure for the settlement of

all or any disputes arising under thle Decree or concerning the amount of

income tax due or to be paid thereunder. Such disputes shall thereafter be

settled In accordance with the procedure ao established and the Courts shall

not have Jurisdiction In respect of them so long as tha agreement remains In

affect.

Article 13* - The provisions of the Bahrain Income Tax Decree, 195?,

shall not apply w 1 th"'***\™l*S~*™*T 31**—

December, 1951*'. ............... ............

5.