Page 283 - Records of Bahrain (7) (ii)_Neat

P. 283

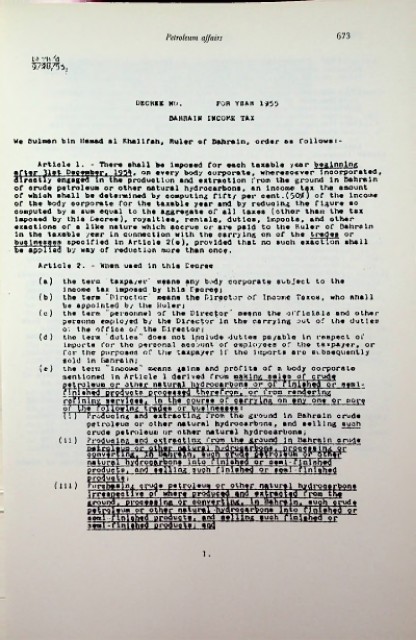

Petroleum affairs 673

bl VI'. <d

DBCHKK HO. FOR YBAtt 1^53

BAHRAIN IHCOKK TAX

We Sulraan bln lltMd a 1 Khallfati, Ruler of Bahrain, order aa follows i-

Artlolo 1. - Thar# shall ha imposed for each taxable year beginning

it Pec amber. 1934 • on every body corporate, whereooever incorporated,

•din the product ion and extraction from the ground In Bahrain

of crude petroleum or other natural hydrocarbons, an income tax the amount

of whlah shall be determined by computing fifty per cent.(30/) of the Income

of the body corporate for the taxable year and by reducing the figure eo

oomputed by a sum equal to the aggregate of all taxee (othor than the tax

iapoaed by thle Decree), royaltlee, rentals, duties, ltr.poots, and other

exaotlona of e like nature which accrue or are paid to the Ruler of Bahrein

in the taxable /ear in connection with the oarrylng on of the trades or

bug Incases npeoifled in Article 2(e), provided that no such exaction shall

be applied by way of reduction more than ono?.

Article 2. - When used in thla Decree

(a) the tern taxpayer' mgano any body corporate subject to the

income tax imposed by this Pearcej

(b) the term "Director' mean a the Director of Income Texos, who shall

bo appointed by the Ruler;

(c) the term "personnel of the Director" megnn the officials end other

persona employed by the Director In the carrying out of the duties

of the office of the Director;

(d ) the tern duties" does not lfiolude dutleo payable In raspect of

Imports for the personal aoaount of employees of the taxpayer, or

Tor the purposes of the taxpayer if tho imports arc subsequent!y

sold in Bahrain;

(c) the tciTa " Income" coesno gains and profits of a body oorporato

mentioned in Article 1 derived from making gale o of crude

pet pal sum or other natural hydrocarbons or of' rlolahcd orjfol-

fTnrehej'pTyjucta proqeesyj therefrom, "or ivrom rendering

refining eervlges. fi) the course of carryIna on tny one or more

or~U)e TotlowInS""trades or businesses i

Ti ) Producing and extracting"x*iron» the ground in Eahraln crude

petroleum or other natural hydrooarbons, and selling auah

orude petroleum or other natural hydrocarbons;

(11) Prod vie l na end extracting from the ground in Bahrain orude

nature! hydroqarponi Into » Injohsd or ofsTj^'f inlnhtd

produc EpT a n4 if lying guoh~ f Ynlsned or soml : r VnTgKed

* iroftuQ ti;

(Ill) ureHas ftu crude petroleum pr other natural hydrocarbons

irreapt fctive pr where produced and extracted froatha

ground. proqesginft or converting, In Bahrain, euoh crude

petroleum or other natural hydrocarbons Into finished or

com! fin ghed products, and selling fuoh finished qr

aemi-Hnishcd products7 sad

1.