Page 284 - Records of Bahrain (7) (ii)_Neat

P. 284

I

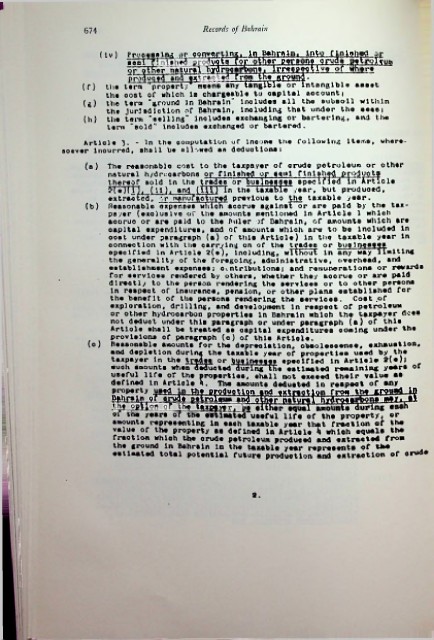

674 Records of Bahrain

(lv) Processing or converting, in Bahrain, into rinjahofl Jr

proffvgiq Tor other perWQr>» qrvde pfrrgTyum

seal EKUt8X3Xft

or other natural hydrocarbon#«IrrffgCC ? lvp or where

Pt\^duq»j1m5 axVraotcd from thf Kttvm.-

(f) the term '’property* meens any tangible or In ntnngiblo asset

the ooat of wbioh is chargeable to capital accountj

U) the term "around In Bahrain” Include® all the subsoil within

the JurJ ®dlotion oC Bahrain, including that under the setei

(h) the term "selling” Includes exobanging or bartering, and the

term ''acid*' lnoludea exchanged or bartered.

Article 3. - In the computation of lnoome the following Items, where

soever lnourred, shall be allowed as deductions i

(a) The reasonable coot to the taxpayer of crude petroleum or other

natural hydro carbons or finished of sc»»l finished Products

thereof sold in the trades or builnteaes apeolricd In Article

?(e)U), (ll), and (ClU~In the taxable year, but produoed,

extracted, :.r manufactured previous to the taxable year.

(b) Reasonable oxpensea which acorue against or are paid by the tax

payer (exclusive of the amounts mentioned in Article 1 which

aooruo or are paid to the Ruler ;f Bahrain, of amount# which are

oapltal expenditures, and of amounts whloh are to be Included In

ooet under paragraph (a) or this Article) In the taxable year in

connection with the carrying on of the trades or businesses

opeoiflsd in Article 2(e), including, wTtKouE in any way limiting

the generality of the foregoing, adalnlstrat1ve, overhead, and

establishment expenses; contributions j and remunerations or reward#

for services rendered by others, whether they accrue or are paid

directly to the peraon rendering the servloeo or to other persons

in reapeot or lnaurancs, pension, or other plana aatabllahed for

the benefit of the persons rendering the services. Cost of

exploration, drilling, and development In respect of petroleum

or other hydrocarbon properties In Bahrain which the taxpayer does

not deduot under this paragraph or under paragraph (a) of this

Artlole ehall be treated ee oapltal expenditures coming under the

provisions of paragraph (o) of this Artlole.

(o) Reasonable amounts for the depreciation, obaoleooenoe, exhaustion,

and depletion during the taxable year of properties used by the

taxpayer In the trades or bmincfiee epeclfled in Artlele 2(e)|

suoh amounts when deducted during the estimated remaining years or

useful life or the properties, ehall not exeeed their value at

defined in Article A. The amounts dedusted in respect of any

property u.ffl In U\f prpdwoUoni »n<3 »»tr»otlon fro« IB

.igTOicCTMagMnr:v:i.w f either equal amounts during eaan

or tn# years or the estimated useful life of the property, or

amounts representing in each taxable year that fraction or the

value of the property as defined in Artlole a whloh equal# tha

fraction which the crude petroleum produced and extracted from

the ground in Bahrain In the taxable year represents of tha

••Hasted total potential future production and extraction of orud

a.