Page 285 - Records of Bahrain (7) (ii)_Neat

P. 285

r

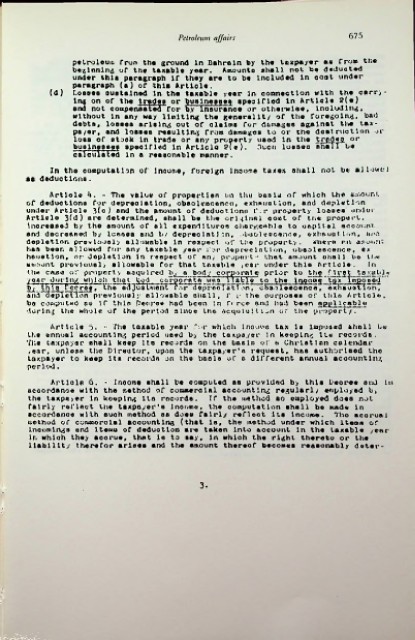

Petroleum affairs 675

petroleum from the around JLn Bahrein by the taxpayer as fro* ti:a

beginning of tht taxable year. Amounto sliall not ba deducted

under thla paragraph If they are to be Included In coat under

paragraph (a) of thla Article.

(d) I.oaoee ouatalned In the taxable year In connection with the oarr}-

on or tb« £ or businesses spealflod In Article 2(e)

3 not cottpeneated for by Insurance or otherwise, including,

without In any way Halting the generality of the foregoing, bad

debt*, looeea arising out of claims for damages agalnat ti*e tax

payer, and losses resulting from damages to or the destruction or

looo of stcok In trade or any property usod In the trfld <dp or

businesses ©poolfled In Article 2(e). Hucn lessee ahail be

calculated In a reaeonnble manner.

In the computation of Income, foreign Income taxes ahall not be allowej

•a deductions.

Artlolo A. - The value of propertlen on the basin of which the amount,

of dedoctlona for depreciation* obao j.v.ac*nc<i, exhaust Ion* and depletion

under Artlolo 3(c) and the amount or deductions f;r property loasea under

Article 3(d) ore determined* shall be the original coat of tr.e propert*

increased by the amount of all expend Huron chorj/.oAh] o t.o capital account

and decreased by lunnea and by depredation, «buol essence, exheuot-l<*n, urn

depletion previously allowable in respect of the property . Where #u\ as own?

has been allowed for any taxable year fer depreciation, obsolescence, ex

houstion, or dopletlon In respect of nri, property that amount ohall be the

asmont previously allowable for that taxable ,car under thla Article, In

the efusa of property acquired h> a bod? corporate prior to the Mrgt taxable

year Purina which that tod, corporate if a a liable to the 1 rv?o»e te/x lmpoood

b i IKTij f~ cores* the aiHualittenT "far d spree Tat Ion, cKaoTeeoence, exhaust ion7

and"depletion previously allowable ohall, f ;• the purpose* of thio Article,

be coaipotad no If thla Decree had been In frree and hud been appl Icable

during the whole of the period since the acquiuiiion or the property.

Article ;b. The taxable year fur which 1 no'.mas tax la Imposed shall be

the annual accounting period need by the taxpayer in keeping lie records .

The taxpayer ehall keep its records on the boa in of 6 Christ 1 an calendar

,ear, unlofiift the Dlreotor, upon the taxpayer’s request, has authorised tho

taxpayer to keep ita records on the bools of a different annual accounting

period.

Article 6. Income ehall be computed ao provided b> this Leore# and in

accordance with the method of commercial accounting regularly employed by

; the taxpayer In keeping Its records. If tha method ao employed does not

fairly reflect the taxpayer’s Inoome, the computation shall be Made In

accordance with euch method ss does fairly reflect its Income. Tho accrual

iteihod of coruaorolel accounting (that Is, the method under which Item* of

Incomings and lteuu of deduction ere taken into account In the taxable year

In which they accrue, that is to say. In which the right thereto or the

liability therefor arises and the amount thereof becomes reasonably deter-

3.

v<

'