Page 42 - CSJ - ADF - AMB 10 07 19

P. 42

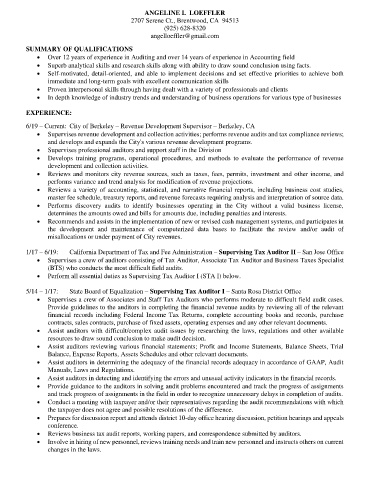

ANGELINE I. LOEFFLER

2707 Serene Ct., Brentwood, CA 94513

(925) 628-8320

angelloeffler@gmail.com

SUMMARY OF QUALIFICATIONS

• Over 12 years of experience in Auditing and over 14 years of experience in Accounting field

• Superb analytical skills and research skills along with ability to draw sound conclusion using facts.

• Self-motivated, detail-oriented, and able to implement decisions and set effective priorities to achieve both

immediate and long-term goals with excellent communication skills

• Proven interpersonal skills through having dealt with a variety of professionals and clients

• In depth knowledge of industry trends and understanding of business operations for various type of businesses

EXPERIENCE:

6/19 – Current: City of Berkeley – Revenue Development Supervisor – Berkeley, CA

• Supervises revenue development and collection activities; performs revenue audits and tax compliance reviews;

and develops and expands the City's various revenue development programs.

• Supervises professional auditors and support staff in the Division

• Develops training programs, operational procedures, and methods to evaluate the performance of revenue

development and collection activities.

• Reviews and monitors city revenue sources, such as taxes, fees, permits, investment and other income, and

performs variance and trend analysis for modification of revenue projections.

• Reviews a variety of accounting, statistical, and narrative financial reports, including business cost studies,

master fee schedule, treasury reports, and revenue forecasts requiring analysis and interpretation of source data.

• Performs discovery audits to identify businesses operating in the City without a valid business license,

determines the amounts owed and bills for amounts due, including penalties and interests.

• Recommends and assists in the implementation of new or revised cash management systems, and participates in

the development and maintenance of computerized data bases to facilitate the review and/or audit of

misallocations or under payment of City revenues.

1/17 – 6/19: California Department of Tax and Fee Administration – Supervising Tax Auditor II – San Jose Office

• Supervises a crew of auditors consisting of Tax Auditor, Associate Tax Auditor and Business Taxes Specialist

(BTS) who conducts the most difficult field audits.

• Perform all essential duties as Supervising Tax Auditor I (STA I) below.

5/14 – 1/17: State Board of Equalization – Supervising Tax Auditor I – Santa Rosa District Office

• Supervises a crew of Associates and Staff Tax Auditors who performs moderate to difficult field audit cases.

Provide guidelines to the auditors in completing the financial revenue audits by reviewing all of the relevant

financial records including Federal Income Tax Returns, complete accounting books and records, purchase

contracts, sales contracts, purchase of fixed assets, operating expenses and any other relevant documents.

• Assist auditors with difficult/complex audit issues by researching the laws, regulations and other available

resources to draw sound conclusion to make audit decision.

• Assist auditors reviewing various financial statements; Profit and Income Statements, Balance Sheets, Trial

Balance, Expense Reports, Assets Schedules and other relevant documents.

• Assist auditors in determining the adequacy of the financial records adequacy in accordance of GAAP, Audit

Manuals, Laws and Regulations.

• Assist auditors in detecting and identifying the errors and unusual activity indicators in the financial records.

• Provide guidance to the auditors in solving audit problems encountered and track the progress of assignments

and track progress of assignments in the field in order to recognize unnecessary delays in completion of audits.

• Conduct a meeting with taxpayer and/or their representatives regarding the audit recommendations with which

the taxpayer does not agree and possible resolutions of the difference.

• Prepares for discussion report and attends district 10-day office hearing discussion, petition hearings and appeals

conference.

• Reviews business tax audit reports, working papers, and correspondence submitted by auditors.

• Involve in hiring of new personnel, reviews training needs and train new personnel and instructs others on current

changes in the laws.