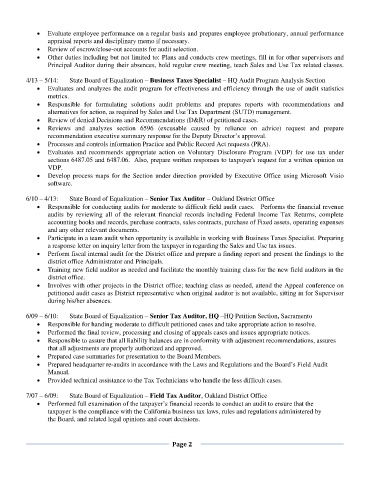

Page 43 - CSJ - ADF - AMB 10 07 19

P. 43

• Evaluate employee performance on a regular basis and prepares employee probationary, annual performance

appraisal reports and disciplinary memo if necessary.

• Review of escrow/close-out accounts for audit selection.

• Other duties including but not limited to: Plans and conducts crew meetings, fill in for other supervisors and

Principal Auditor during their absences, hold regular crew meeting, teach Sales and Use Tax related classes.

4/13 – 5/14: State Board of Equalization – Business Taxes Specialist – HQ Audit Program Analysis Section

• Evaluates and analyzes the audit program for effectiveness and efficiency through the use of audit statistics

metrics.

• Responsible for formulating solutions audit problems and prepares reports with recommendations and

alternatives for action, as required by Sales and Use Tax Department (SUTD) management.

• Review of denied Decisions and Recommendations (D&R) of petitioned cases.

• Reviews and analyzes section 6596 (excusable caused by reliance on advice) request and prepare

recommendation executive summary response for the Deputy Director’s approval.

• Processes and controls information Practice and Public Record Act requests (PRA).

• Evaluates and recommends appropriate action on Voluntary Disclosure Program (VDP) for use tax under

sections 6487.05 and 6487.06. Also, prepare written responses to taxpayer's request for a written opinion on

VDP.

• Develop process maps for the Section under direction provided by Executive Office using Microsoft Visio

software.

6/10 – 4/13: State Board of Equalization – Senior Tax Auditor – Oakland District Office

• Responsible for conducting audits for moderate to difficult field audit cases. Performs the financial revenue

audits by reviewing all of the relevant financial records including Federal Income Tax Returns, complete

accounting books and records, purchase contracts, sales contracts, purchase of Fixed assets, operating expenses

and any other relevant documents.

• Participate in a team audit when opportunity is available in working with Business Taxes Specialist. Preparing

a response letter on inquiry letter from the taxpayer in regarding the Sales and Use tax issues.

• Perform fiscal internal audit for the District office and prepare a finding report and present the findings to the

district office Administrator and Principals.

• Training new field auditor as needed and facilitate the monthly training class for the new field auditors in the

district office.

• Involves with other projects in the District office; teaching class as needed, attend the Appeal conference on

petitioned audit cases as District representative when original auditor is not available, sitting in for Supervisor

during his/her absences.

6/09 – 6/10: State Board of Equalization – Senior Tax Auditor, HQ –HQ Petition Section, Sacramento

• Responsible for handing moderate to difficult petitioned cases and take appropriate action to resolve.

• Performed the final review, processing and closing of appeals cases and issues appropriate notices.

• Responsible to assure that all liability balances are in conformity with adjustment recommendations, assures

that all adjustments are properly authorized and approved.

• Prepared case summaries for presentation to the Board Members.

• Prepared headquarter re-audits in accordance with the Laws and Regulations and the Board’s Field Audit

Manual.

• Provided technical assistance to the Tax Technicians who handle the less difficult cases.

7/07 – 6/09: State Board of Equalization – Field Tax Auditor, Oakland District Office

• Performed full examination of the taxpayer’s financial records to conduct an audit to ensure that the

taxpayer is the compliance with the California business tax laws, rules and regulations administered by

the Board, and related legal opinions and court decisions.

Page 2