Page 11 - LatAmOil Week 19 2022

P. 11

LatAmOil BRAZIL LatAmOil

They also told US officials that Petrobras did not Petrobras, meanwhile, said in a statement

have the logistical wherewithal to boost oil out- viewed by Reuters that it had not met with “rep-

put temporarily, even though it aimed to raise resentatives of the US State Department.”

yields by 500,000 barrels per day (bpd) by 2026 When asked for clarification, the NOC

as part of its medium-term plan, the sources declined to say whether it had had any contact

said. with officials from another US government

As of press time, neither the US government agency.

nor Petrobras had officially confirmed that the Brazil’s Mines and Energy Minister Bento

meeting took place. Albuquerque had told Reuters in April that he

A spokesperson for the US State Department met twice with US Energy Secretary Jennifer

revealed little in a statement sent to Reuters. “We Granholm to discuss his country’s role in stabi-

are ... doing everything possible with our allies lising the global crude oil market.

and partners to mitigate the economic impacts He did not reveal many details of those talks,

of Russian actions on other economies like Bra- but he had commented in late March that he

zil,” she said. “We are working with energy com- expected Brazilian oil producers to ramp up

panies to surge their capacity to supply energy to production to some extent to take advantage of

the market, particularly as prices increase.” rising prices.

Petro Rio set to acquire 90%

stake in Albacora Leste field

BRAZIL’S Petro Rio is set to acquire a 90% share

in the Albacora Leste field after striking a deal

worth $1.951bn with the national oil company

(NOC) Petrobras.

This transaction will allow Petro Rio take

control of the operation of the Albacora Leste

oilfield, subject to the approval of the National

Agency of Petroleum, Natural Gas and Biofuels

(ANP), as well as CADE, the Brazilian anti-trust

entity. Once this milestone has been reached,

Petro Rio must pay $293mn upon signing the

deal in addition to $1.658bn at the time of the

acquisition’s completion and the transfer of

operations.

Additionally, Petro Rio may be required to

make up to $250mn in additional payments,

depending on the changes in the average price

of Brent crude in 2023 and 2024.

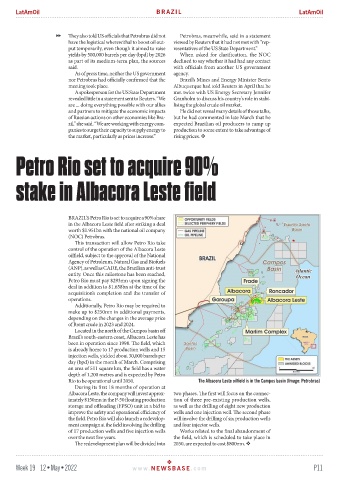

Located in the north of the Campos basin off

Brazil’s south-eastern coast, Albacora Leste has

been in operation since 1998. The field, which

is already home to 17 production wells and 15

injection wells, yielded about 30,000 barrels per

day (bpd) in the month of March. Comprising

an area of 511 square km, the field has a water

depth of 1,200 metres and is expected by Petro

Rio to be operational until 2050. The Albacora Leste oilfield is in the Campos basin (Image: Petrobras)

During its first 18 months of operation at

Albacora Leste, the company will invest approx- two phases. The first will focus on the connec-

imately $150mn in the P-50 floating production tion of three pre-existing production wells,

storage and offloading (FPSO) unit in a bid to as well as the drilling of eight new production

improve the safety and operational efficiency of wells and one injection well. The second phase

the field. Petro Rio will also launch a redevelop- will involve the drilling of six production wells

ment campaign at the field involving the drilling and four injector wells.

of 17 production wells and five injection wells Works related to the final abandonment of

over the next five years. the field, which is scheduled to take place in

The redevelopment plan will be divided into 2050, are expected to cost $800mn.

Week 19 12•May•2022 www. NEWSBASE .com P11