Page 36 - Russia OUTLOOK 2023

P. 36

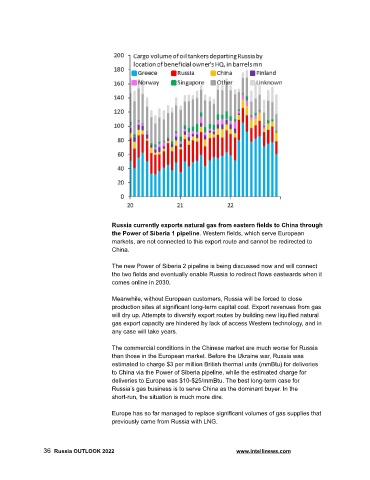

Russia currently exports natural gas from eastern fields to China through

the Power of Siberia 1 pipeline. Western fields, which serve European

markets, are not connected to this export route and cannot be redirected to

China.

The new Power of Siberia 2 pipeline is being discussed now and will connect

the two fields and eventually enable Russia to redirect flows eastwards when it

comes online in 2030.

Meanwhile, without European customers, Russia will be forced to close

production sites at significant long-term capital cost. Export revenues from gas

will dry up. Attempts to diversify export routes by building new liquified natural

gas export capacity are hindered by lack of access Western technology, and in

any case will take years.

The commercial conditions in the Chinese market are much worse for Russia

than those in the European market. Before the Ukraine war, Russia was

estimated to charge $3 per million British thermal units (mmBtu) for deliveries

to China via the Power of Siberia pipeline, while the estimated charge for

deliveries to Europe was $10-$25/mmBtu. The best long-term case for

Russia’s gas business is to serve China as the dominant buyer. In the

short-run, the situation is much more dire.

Europe has so far managed to replace significant volumes of gas supplies that

previously came from Russia with LNG.

36 Russia OUTLOOK 2022 www.intellinews.com