Page 10 - MEOG Week 42 2021

P. 10

MEOG PROJECTS & COMPANIES MEOG

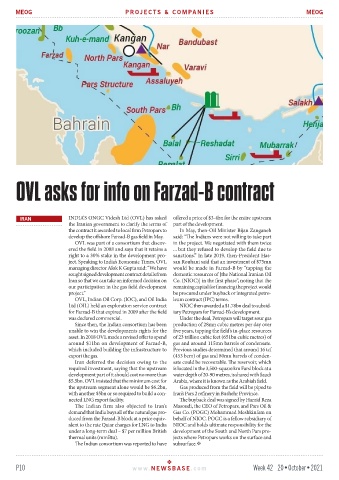

OVL asks for info on Farzad-B contract

IRAN INDIA’S ONGC Videsh Ltd (OVL) has asked offered a price of $3-4bn for the entire upstream

the Iranian government to clarify the terms of part of the development.

the contract it awarded to local firm Petropars to In May, then-Oil Minister Bijan Zanganeh

develop the offshore Farzad-B gas field in May. said: “The Indians were not willing to take part

OVL was part of a consortium that discov- in the project. We negotiated with them twice

ered the field in 2008 and says that it retains a ... but they refused to develop the field due to

right to a 30% stake in the development pro- sanctions.” In late 2019, then-President Has-

ject. Speaking to India’s Economic Times, OVL san Rouhani said that an investment of $75mn

managing director Alok K Gupta said: “We have would be made in Farzad-B by “tapping the

sought signed development contract details from domestic resources of [the National Iranian Oil

Iran so that we can take an informed decision on Co. (NIOC)] in the first phase”, noting that the

our participation in the gas field development remaining capital for financing the project would

project.” be procured under buyback or integrated petro-

OVL, Indian Oil Corp. (IOC), and Oil India leum contract (IPC) terms.

Ltd (OIL) held an exploration service contract NIOC then awarded a $1.78bn deal to subsid-

for Farzad-B that expired in 2009 after the field iary Petropars for Farzad-B’s development.

was declared commercial. Under the deal, Petropars will target sour gas

Since then, the Indian consortium has been production of 28mn cubic metres per day over

unable to win the developments rights for the five years, tapping the field’s in-place resources

asset. In 2018 OVL made a revised offer to spend of 23 trillion cubic feet (651bn cubic metres) of

around $11bn on development of Farzad-B, gas and around 115mn barrels of condensate.

which included building the infrastructure to Previous studies determined that around 16 tcf

export the gas. (453 bcm) of gas and 80mn barrels of conden-

Iran deferred the decision owing to the sate could be recoverable. The reservoir, which

required investment, saying that the upstream is located in the 3,500-square km Farsi block at a

development part of it should cost no more than water depth of 20-90 metres, is shared with Saudi

$5.5bn. OVL insisted that the minimum cost for Arabia, where it is known as the Arabiah field.

the upstream segment alone would be $6.2bn, Gas produced from the field will be piped to

with another $5bn or so required to build a con- Iran’s Pars 2 refinery in Bushehr Province.

nected LNG export facility. The buyback deal was signed by Hamid Reza

The Indian firm also objected to Iran’s Masoudi, the CEO of Petropars, and Pars Oil &

demand that India buys all of the natural gas pro- Gas Co. (POGC) Mohammad Meshkinfam on

duced from the Farzad-B block at a price equiv- behalf of NIOC. POGC is a fellow subsidiary of

alent to the rate Qatar charges for LNG to India NIOC and holds ultimate responsibility for the

under a long-term deal – $7 per million British development of the South and North Pars pro-

thermal units (mmBtu). jects where Petropars works on the surface and

The Indian consortium was reported to have subsurface.

P10 www. NEWSBASE .com Week 42 20•October•2021