Page 5 - FSUOGM Week 08 2021

P. 5

FSUOGM COMMENTARY FSUOGM

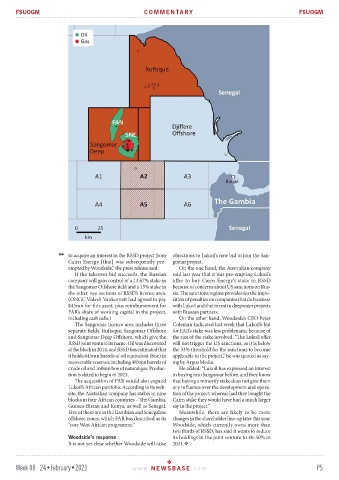

to acquire an interest in the RSSD project from objections to Lukoil’s new bid to join the San-

Cairn Energy [that] was subsequently pre- gomar project.

empted by Woodside,” the press release said. On the one hand, the Australian company

If the takeover bid succeeds, the Russian said last year that it was pre-empting Lukoil’s

company will gain control of a 13.67% stake in offer to buy Cairn Energy’s stake in RSSD

the Sangomar Offshore field and a 15% stake in because of concerns about US sanctions on Rus-

the other two sections of RSSD’s licence area. sia. The sanctions regime provides for the impo-

(ONGC Videsh Vankorneft had agreed to pay sition of penalties on companies that do business

$45mn for this asset, plus reimbursement for with Lukoil and that invest in deepwater projects

FAR’s share of working capital in the project, with Russian partners.

including cash calls.) On the other hand, Woodside’s CEO Peter

The Sangomar licence area includes three Coleman indicated last week that Lukoil’s bid

separate fields: Rufisque, Sangomar Offshore for FAR’s stake was less problematic because of

and Sangomar Deep Offshore, which give the the size of the stake involved. “The Lukoil offer

RSSD joint venture its name. Oil was discovered will not trigger the US sanctions, as it is below

at the block in 2014, and RSSD has estimated that the 33% threshold for the sanctions to become

it holds 645mn barrels of oil equivalent (boe) in applicable to the project,” he was quoted as say-

recoverable reserves, including 485mn barrels of ing by Argus Media.

crude oil and 160mn boe of natural gas. Produc- He added: “Lukoil has expressed an interest

tion is slated to begin in 2023. in buying into Sangomar before, and they know

The acquisition of FAR would also expand that having a minority stake does not give them

Lukoil’s African portfolio. According to its web- any influence over the development and opera-

site, the Australian company has stakes in nine tion of the project, whereas had they bought the

blocks in four African countries – The Gambia, Cairn stake they would have had a much larger

Guinea-Bissau and Kenya, as well as Senegal. say in the project.”

Five of these are in the Gambian and Senegalese Meanwhile, there are likely to be more

offshore zones, which FAR has described as its changes in the shareholder line-up later this year.

“core West African programme.” Woodside, which currently owns more than

two thirds of RSSD, has said it wants to reduce

Woodside’s response its holdings in the joint venture to 40-50% in

It is not yet clear whether Woodside will raise 2021.

Week 08 24•February•2021 www. NEWSBASE .com P5