Page 5 - FSUOGM Week 43 2022

P. 5

FSUOGM COMMENTARY FSUOGM

exports of gas to Europe. And indeed that gas business profitability,” says Nicholas Farr, an

flow has indeed largely stopped after a series of emerging Europe economist with Capital Eco-

explosions destroyed three of the four strands nomics. “Third, by reversing some of the deteri-

of the two Nord Stream gas pipelines that run oration in countries’ terms of trade and reducing

under the Baltic Sea on September 26. A reduced how much government support is needed to

flow of gas continues to transverse Ukraine and soften the blow of high prices, it should restrict

the TurkStream pipeline continues to oper- any further deterioration of external and fiscal

ate, although the capacity of that pipeline is far positions.”

smaller than Nord Stream. The relief will be largest in the countries with

Another problem is that record-high Euro- the biggest current account deficits, especially

pean demand and customers that are willing to Hungary and Turkey.

pay ten-times the usual market rates have sucked “Hungary is one of the most dependent in

in a large supply of LNG carriers that now find Europe on gas for its energy needs and Hungar-

they can’t unload their gas. ian assets have come under significant pressure

An economic slowdown in China has left it this year as energy prices have surged,” says Farr.

with a surplus of Russian LNG that it has been Hungary’s central bank has scrambled to

reselling to Europe, accounting for 7% of the prop up the sinking forint with a series of emer-

total LNG supplies in September. gency intra-meeting extreme rate hikes in an

A crunch in both supply and prices may come effort to cap soaring inflation. But more recently

soon, as Brussels is currently discussing how to at the end of September the Hungarian national

impose a price cap mechanism on European bank (MNB) decided to pause the hikes at the

gas imports as part of an eighth sanctions pack- end of September, but put through fresh emer-

age. Importantly, at a EU ministers meeting in gency rate hikes in the middle of October, after

Brussels last week Berlin dropped its objections it realised it had not done enough to stop the rot.

to a gas price cap, although the details of the The regulator also said it would start providing

mechanism have not been agreed on and will be foreign exchange reserves to finance energy

worked out in the coming weeks. imports.

“Hungary’s central bank, as well as others in

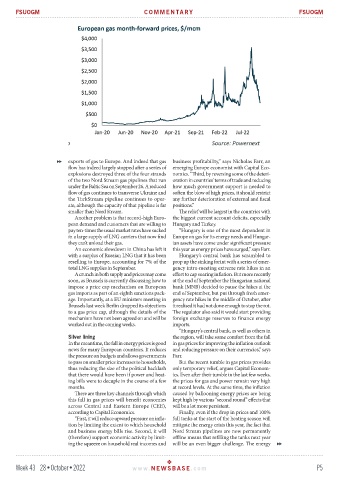

Silver lining the region, will take some comfort from the fall

In the meantime, the fall in energy prices is good in gas prices for improving the inflation outlook

news for many European countries. It reduces and reducing pressure on their currencies,” says

the pressure on budgets and allows governments Farr.

to pass on smaller price increases to households, But the recent tumble in gas prices provides

thus reducing the size of the political backlash only temporary relief, argues Capital Econom-

that there would have been if power and heat- ics. Even after their tumble in the last few weeks,

ing bills were to decuple in the course of a few the prices for gas and power remain very high

months. at record levels. At the same time, the inflation

There are three key channels through which caused by ballooning energy prices are being

this fall in gas prices will benefit economies kept high by various “second round” effects that

across Central and Eastern Europe (CEE), will be a lot more persistent.

according to Capital Economics. Finally, even if the drop in prices and 100%

“First, it will reduce upward pressure on infla- full tanks at the start of the heating season will

tion by limiting the extent to which household mitigate the energy crisis this year, the fact that

and business energy bills rise. Second, it will Nord Stream pipelines are now permanently

(therefore) support economic activity by limit- offline means that refilling the tanks next year

ing the squeeze on household real incomes and will be an even bigger challenge. The energy

Week 43 28•October•2022 www. NEWSBASE .com P5