Page 8 - FSUOGM Week 43 2022

P. 8

FSUOGM COMMENTARY FSUOGM

markets in Asia, the building of new gas pipe- of capacity of all announced projects is around

lines to China will take at least until the end of 50%,” the report says.

this decade and sanctions have limited Russia’s The IEA annual report included a baseline

ability to expand its LNG production. scenario that assumes that global demand for

fossil fuels will peak around 2025, after which

Investing into green energy it will begin to fall. This is the first time that an

The crisis has forced the governments of the IEA report has included a forecast where fossil

world’s largest countries – the United States, the fuel use will plateau or decline as its base case

European Union, Japan, South Korea, China and for each of the three main fossil fuels. Coal use

India – to also want to change their sources of will peak in a few years’ time. Gas use will peak

energy and accelerate their efforts to switch to by the end of the 2020s. And oil use will peak in

renewables, which has now become a national the mid-2030s. The share of fossil fuels in total

security issue as well as a climate crisis issue. energy consumption, which has long remained

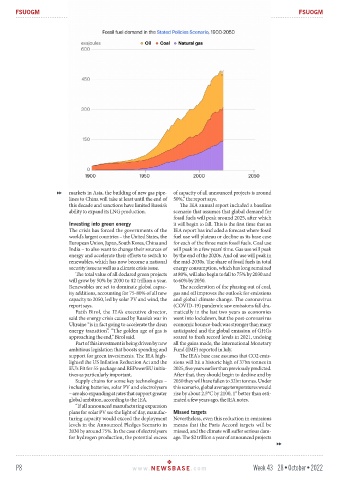

The total value of all declared green projects at 80%, will also begin to fall to 75% by 2030 and

will grow by 50% by 2030 to $2 trillion a year. to 60% by 2050.

Renewables are set to dominate global capac- The acceleration of the phasing out of coal,

ity additions, accounting for 75-80% of all new gas and oil improves the outlook for emissions

capacity to 2050, led by solar PV and wind, the and global climate change. The coronavirus

report says. (COVID-19) pandemic saw emissions fall dra-

Fatih Birol, the IEA’s executive director, matically in the last two years as economies

said the energy crisis caused by Russia’s war in went into lockdown, but the post-coronavirus

Ukraine “is in fact going to accelerate the clean economic bounce-back was stronger than many

energy transition”. “The golden age of gas is anticipated and the global emission of GHGs

approaching the end,” Birol said. soared to fresh record levels in 2021, undoing

Part of this investment is being driven by new all the gains made, the International Monetary

ambitious legislation that boosts spending and Fund (IMF) reported in July.

support for green investments. The IEA high- The IEA's base case assumes that CO2 emis-

lighted the US Inflation Reduction Act and the sions will hit a historic high of 37bn tonnes in

EU’s Fit for 55 package and REPowerEU initia- 2025, five years earlier than previously predicted.

tives as particularly important. After that, they should begin to decline and by

Supply chains for some key technologies – 2050 they will have fallen to 32bn tonnes. Under

including batteries, solar PV and electrolysers this scenario, global average temperatures would

– are also expanding at rates that support greater rise by about 2.5°C by 2100, 1° better than esti-

global ambition, according to the IEA. mated a few years ago, the IEA notes.

“If all announced manufacturing expansion

plans for solar PV see the light of day, manufac- Missed targets

turing capacity would exceed the deployment Nevertheless, even this reduction in emissions

levels in the Announced Pledges Scenario in means that the Paris Accord targets will be

2030 by around 75%. In the case of electrolysers missed, and the climate will suffer serious dam-

for hydrogen production, the potential excess age. The $2 trillion a year of announced projects

P8 www. NEWSBASE .com Week 43 28•October•2022