Page 5 - FSUOGM Week 24 2021

P. 5

FSUOGM COMMENTARY FSUOGM

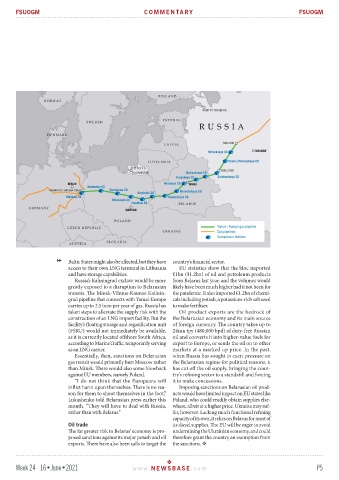

Baltic States might also be affected, but they have country’s financial sector.

access to their own LNG terminal in Lithuania EU statistics show that the bloc imported

and have storage capabilities. €1bn ($1.2bn) of oil and petroleum products

Russia’s Kaliningrad exclave would be more from Belarus last year, and the volumes would

greatly exposed to a disruption to Belarusian likely have been much higher had it not been for

transits. The Minsk-Vilnius-Kaunas-Kalinin- the pandemic. It also imported €1.2bn of chemi-

grad pipeline that connects with Yamal-Europe cals including potash, a potassium-rich salt used

carries up to 2.5 bcm per year of gas. Russia has to make fertiliser.

taken steps to alleviate the supply risk with the Oil product exports are the bedrock of

construction of an LNG import facility. But the the Belarusian economy and its main source

facility’s floating storage and regasification unit of foreign currency. The country takes up to

(FSRU) would not immediately be available, 24mn tpy (480,000 bpd) of duty-free Russian

as it is currently located offshore South Africa, oil and converts it into higher-value fuels for

according to MarineTraffic, temporarily serving export to Europe, or sends the oil on to other

as an LNG carrier. markets at a marked up price. In the past,

Essentially, then, sanctions on Belarusian when Russia has sought to exert pressure on

gas transit would primarily hurt Moscow rather the Belarusian regime for political reasons, it

than Minsk. There would also some blowback has cut off the oil supply, bringing the coun-

against EU members, namely Poland. try’s refining sector to a standstill and forcing

“I do not think that the Europeans will it to make concessions.

inflict harm upon themselves. There is no rea- Imposing sanctions on Belarusian oil prod-

son for them to shoot themselves in the foot,” ucts would have limited impact on EU states like

Lukashenko told Belarusian press earlier this Poland, who could readily obtain supplies else-

month. “They will have to deal with Russia, where, albeit at a higher price. Ukraine may suf-

rather than with Belarus.” fer, however. Lacking much functional refining

capacity of its own, it relies on Belarus for most of

Oil trade its diesel supplies. The EU will be eager to avoid

The far greater risk to Belarus’ economy is pro- undermining the Ukrainian economy, and could

posed sanctions against its major potash and oil therefore grant the country an exemption from

exports. There have also been calls to target the the sanctions.

Week 24 16•June•2021 www. NEWSBASE .com P5