Page 13 - LatAmOil Week 38

P. 13

LatAmOil ECUADOR LatAmOil

It will, for example, have to cover the cost of PetroEcuador’s monopoly on oil refining. The

installing deep conversion technology that state-owned company has long had the exclu-

will enable the plant to turn out higher-quality sive right to process crude, but the government

petroleum products that meet Euro-5 stand- believes that bringing private-sector partners on

ards. According to PetroEcuador, this particular board will help quell corruption and improve

scheme has the potential to reduce the country’s performance. It also hopes that the introduction

fuel import bill by $300mn per year. of market-driven pricing on the domestic mar-

The NOC also envisions a number of other ket will make downstream investments more

upgrades and improvements for the Esmeral- attractive.

das refinery. It wants the operator to expand the The Esmeraldas plant languished under

processing of residual fuel oil (RFO) into Euro-5 the country’s previous government, headed by

fuels and to increase production capacity in Rafael Correa.

light of the rise in domestic petroleum product While Correa was in office between 2007

consumption. and 2017, Ecuador spent no less than $2.2bn on

The operating contract will effectively end faulty repair work at the refinery.

COLOMBIA

Fitch affirms Promigas ratings,

says company’s outlook is stable

US-BASED Fitch Ratings said last week that capacity is due to expire before the end of the

it had affirmed the credit ratings of Promi- year, it reported.

gas, a Colombian natural gas transporter, and Fitch also stated that it did not expect the

reported that its outlook for the company was company’s credit ratings to be affected by possi-

stable. ble legal action against Toronto-listed Canacol.

In a statement, Fitch reported that it was Promigas is looking into seeking compensation

affirming Promigas’ long-term foreign and for the Canadian firm’s unilateral decision to

local currency issuer default ratings (IDRs) exit a project that would have expanded Colom-

at BBB-, with a stable outlook. It did the same bia’s gas transport capacity by 100mn cubic feet

for a $400mn issue by Promigas and Gases del (2.8mn cubic metres) per day, it explained.

Pacifico of senior unsecured notes that are due

to mature in 2029, keeping the ratings for the

securities at BBB-. The long-term national scale

rating is AAA(col), with a stable outlook, and

the short-term national scale rating is F1+(col),

it added.

The agency explained its decision by noting

that Promigas had retained a “strong business

position in the natural gas transportation and

distribution sectors in Colombia.” The com-

pany is Colombia’s second largest transporter of

gas, controlling about 45% of the country’s gas

pipeline network and serving about 38% of all

connected gas consumers, it said. Additionally,

it delivers gas to Peru, serving about 93% of that

country’s users.

The company faces few regulatory risks, as

the country’s regulatory framework and rules

are “constructive” and “balanced,” the statement

added.

Promigas, it noted, operates as a natural

monopoly within its own area of influence. This

situation “results in relatively stable and pre-

dictable cash flows, even though Promigas is

exposed to some recontracting risk in its natural

gas transportation business,” it said. The recon-

tracting risk stems from the fact that around

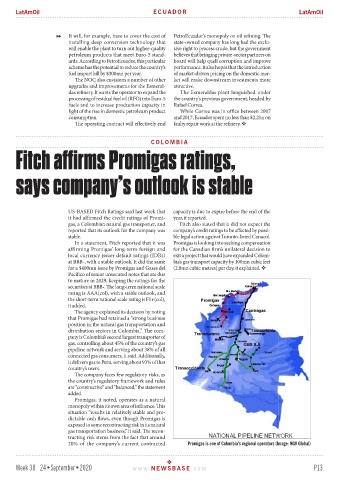

20% of the company’s current contracted Promigas is one of Colombia’s regional operators (Image: NGV Global)

Week 38 24•September•2020 www. NEWSBASE .com P13