Page 14 - DMEA Week 14 2021

P. 14

DMEA PIPELINES DMEA

Apollo in pole position

for Aramco pipeline lease

MIDDLE EAST APOLLO Global Management is reported to be 5mn to 7mn barrels per day (bpd).

leading a group of investors to lease a stake in Continuing the ambiguity and fluidity of the

Saudi Aramco’s oil pipelines business. sale, one source told Bloomberg that Aramco

According to sources quoted by Bloomberg could choose the winner in the coming weeks,

and Reuters, BlackRock and Canada’s Brookfield though it may yet decide not to proceed with the

Asset Management are no longer in the running, deal.

though New York-based Global Infrastructure In October, it was reported that BlackRock

Partners (GIP) remains in the running, while the was in talks to acquire the stake in what Aramco

China Investment Corp. (CIC) sovereign wealth dubbed internally ‘Project Seek’.

fund is considering making a bid. However, talks cooled when appetite for an

In late March, Aramco is believed to have sent agreement under previously discussed terms

a request for proposals (RFP) to a pool of banks diminished amid concern from the conservative

believed to include Al-Ahli NCB, Al Rajhi and Energy Minister Prince Abdulaziz bin Saud, with

Riyad, for funding that it intends to provide to further due diligence deemed necessary.

bidders for the pipeline stake. Meanwhile, with Crown Prince Mohammed

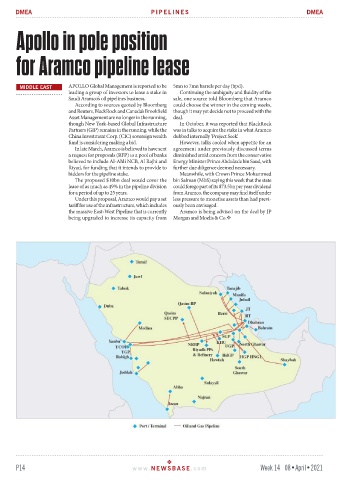

The proposed $10bn deal would cover the bin Salman (MbS) saying this week that the state

lease of as much as 49% in the pipeline division could forego part of its $73.5bn per year dividend

for a period of up to 25 years. from Aramco, the company may find itself under

Under this proposal, Aramco would pay a set less pressure to monetise assets than had previ-

tariff for use of the infrastructure, which includes ously been envisaged.

the massive East-West Pipeline that is currently Aramco is being advised on the deal by JP

being upgraded to increase its capacity from Morgan and Moelis & Co.

P14 www. NEWSBASE .com Week 14 08•April•2021