Page 11 - DMEA Week 12 2022

P. 11

DMEA SUPPLY & PROCESSING DMEA

gas prices may help ease concerns over Alge- the rocks with the re-emergence of two compet-

ria’s complicated regulatory framework for the ing governments this month.”

majors, but it’s no guarantee.” He did indicate, though, that he still had

His reservations were not fully shared by Ross some hope. “This isn’t to say that it isn’t possible,

Cassidy, the vice-president of MENA research as further investment could happen without a

at Welligence Energy Analytics. Cassidy told political resolution or even an easing of tensions.

NewsBase last week that if the EU continued Eni and NOC, for example, were reportedly in

to move away from Russia as a supplier of fuel, talks recently over boosting gas reserves,” he

Algeria’s shale gas fields might start to draw more told NewsBase. “Political risk, however, is likely

interest. But he also stated that he did not expect to remain a key risk for Libya for at least the next

any immediate movement in this direction. 12 months.”

“Algeria could hold large volumes of uncon-

ventional gas. However, this has not been Egypt: Regional co-operation

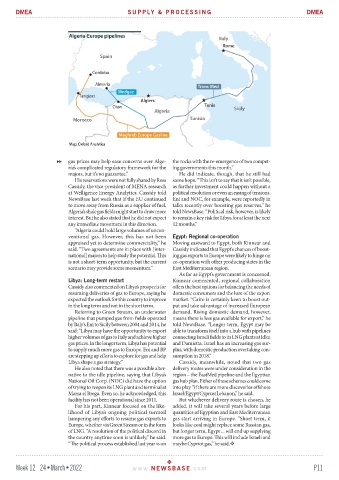

appraised yet to determine commerciality,” he Moving eastward to Egypt, both Kinnear and

said. “Two agreements are in place with [inter- Cassidy indicated that Egypt’s chances of boost-

national] majors to help study the potential. This ing gas exports to Europe were likely to hinge on

is not a short-term opportunity, but the current co-operation with other producing states in the

scenario may provide some momentum.” East Mediterranean region.

As far as Egypt’s government is concerned,

Libya: Long-term restart Kinnear commented, regional collaboration

Cassidy also commented on Libya’s prospects for offers the best options for balancing the needs of

resuming deliveries of gas to Europe, saying he domestic consumers and the lure of the export

expected the outlook for this country to improve market. “Cairo is certainly keen to boost out-

in the long term and not in the short term. put and take advantage of increased European

Referring to Green Stream, an underwater demand. Rising domestic demand, however,

pipeline that pumped gas from fields operated means there is less gas available for export,” he

by Italy’s Eni to Sicily between 2004 and 2014, he told NewsBase. “Longer term, Egypt may be

said: “Libya may have the opportunity to export able to transform itself into a hub with pipelines

higher volumes of gas to Italy and achieve higher connecting Israeli fields to its LNG plants at Idku

gas prices. In the longer term, Libya has potential and Damietta. Israel has an increasing gas sur-

to supply much more gas to Europe. Eni and BP plus, with domestic production overtaking con-

are stepping up efforts to explore for gas and help sumption in 2018.”

Libya shape a gas strategy.” Cassidy, meanwhile, noted that two gas

He also noted that there was a possible alter- delivery routes were under consideration in the

native to the idle pipeline, saying that Libya’s region – the EastMed pipeline and the Egyptian

National Oil Corp. (NOC) did have the option gas hub plan. Either of these schemes could come

of trying to reopen its LNG plant and terminal at into play “if there are more discoveries offshore

Marsa el Brega. Even so, he acknowledged, this Israel/Egypt/Cyprus/Lebanon,” he said.

facility has not been operational since 2011. But whichever delivery route is chosen, he

For his part, Kinnear focused on the like- added, it will take several years before large

lihood of Libya’s ongoing political turmoil quantities of Egyptian and East Mediterranean

hampering any efforts to resume gas exports to gas start arriving in Europe. “Short term, it

Europe, whether via Green Stream or in the form looks like coal might replace some Russian gas,

of LNG. “A resolution of the political discord in but longer term, Egypt ... will end up supplying

the country anytime soon is unlikely,” he said. more gas to Europe. This will include Israeli and

“The political process established last year is on maybe Cypriot gas,” he said.

Week 12 24•March•2022 www. NEWSBASE .com P11