Page 19 - FSUOGM Annual Review 2021

P. 19

FSUOGM AUGUST FSUOGM

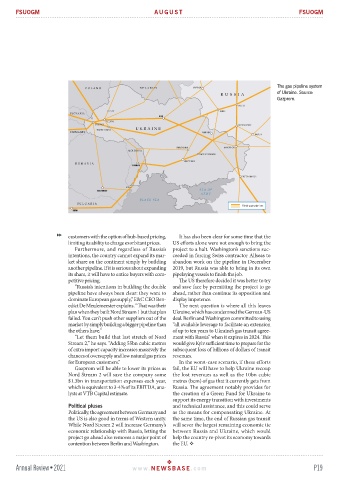

The gas pipeline system

of Ukraine. Source:

Gazprom.

customers with the option of hub-based pricing, It has also been clear for some time that the

limiting its ability to charge exorbitant prices. US efforts alone were not enough to bring the

Furthermore, and regardless of Russia’s project to a halt. Washington’s sanctions suc-

intentions, the country cannot expand its mar- ceeded in forcing Swiss contractor Allseas to

ket share on the continent simply by building abandon work on the pipeline in December

another pipeline. If it is serious about expanding 2019, but Russia was able to bring in its own

its share, it will have to entice buyers with com- pipelaying vessels to finish the job.

petitive pricing. The US therefore decided it was better to try

“Russia’s intentions in building the double and save face by permitting the project to go

pipeline have always been clear: they want to ahead, rather than continue its opposition and

dominate European gas supply,” E&C CEO Ben- display impotence.

edict De Meulemeester explains. “That was their The next question is where all this leaves

plan when they built Nord Stream 1 but that plan Ukraine, which has condemned the German-US

failed. You can’t push other suppliers out of the deal. Berlin and Washington committed to using

market by simply building a bigger pipeline than “all available leverage to facilitate an extension

the others have.” of up to ten years to Ukraine’s gas transit agree-

“Let them build that last stretch of Nord ment with Russia” when it expires in 2024. This

Stream 2,” he says. “Adding 55bn cubic metres would give Kyiv sufficient time to prepare for the

of extra import capacity increases massively the subsequent loss of billions of dollars of transit

chances of oversupply and low natural gas prices revenues.

for European customers.” In the worst-case scenario, if these efforts

Gazprom will be able to lower its prices as fail, the EU will have to help Ukraine recoup

Nord Stream 2 will save the company some the lost revenues as well as the 10bn cubic

$1.3bn in transportation expenses each year, metres (bcm) of gas that it currently gets from

which is equivalent to 3-4% of its EBITDA, ana- Russia. The agreement notably provides for

lysts at VTB Capital estimate. the creation of a Green Fund for Ukraine to

support its energy transition with investments

Political pluses and technical assistance, and this could serve

Politically, the agreement between Germany and as the means for compensating Ukraine. At

the US is also good in terms of Western unity. the same time, the end of Russian gas transit

While Nord Stream 2 will increase Germany’s will sever the largest remaining economic tie

economic relationship with Russia, letting the between Russia and Ukraine, which would

project go ahead also removes a major point of help the country re-pivot its economy towards

contention between Berlin and Washington. the EU.

Annual Review•2021 www. NEWSBASE .com P19