Page 12 - LatAmOil Week 31 2022

P. 12

LatAmOil BRAZIL LatAmOil

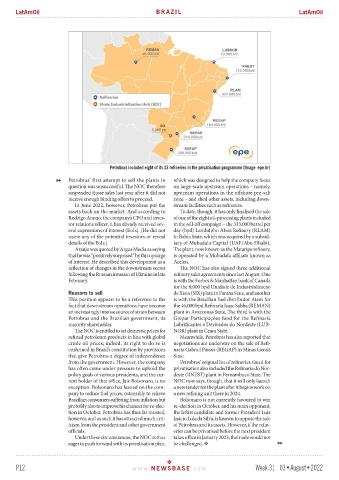

Petrobras included eight of its 13 refineries in the privatisation programme (Image: epe.br)

Petrobras’ first attempt to sell the plants in which was designed to help the company focus

question was unsuccessful. The NOC therefore on large-scale upstream operations – namely,

suspended those sales last year after it did not upstream operations in the offshore pre-salt

receive enough binding offers to proceed. zone – and shed other assets, including down-

In June 2022, however, Petrobras put the stream facilities such as refineries.

assets back on the market. And according to To date, though, it has only finalised the sale

Rodrigo Araujo, the company’s CFO and inves- of one of the eight oil-processing plants included

tor relations officer, it has already received sev- in the sell-off campaign – the 333,000 barrel per

eral expressions of interest (EoIs). (He did not day (bpd) Landulpho Alves Refinery (RLAM)

name any of the potential investors or reveal in Bahia State, which was acquired by a subsid-

details of the EoIs.) iary of Mubadala Capital (UAE/Abu Dhabi).

Araujo was quoted by Argus Media as saying The plant, now known as the Mataripe refinery,

that he was “positively surprised” by this upsurge is operated by a Mubadala affiliate known as

of interest. He described this development as a Acelen.

reflection of changes in the downstream sector The NOC has also signed three additional

following the Russian invasion of Ukraine in late refinery sales agreements since last August. One

February. is with the Forbes & Manhattan bank of Canada

for the 6,000 bpd Unidade de Industrializacao

Reasons to sell de Xisto (SIX) plant in Parana State, and another

This position appears to be a reference to the is with the Brazilian fuel distributor Atem for

fact that downstream operations have become the 46,000 bpd Refinaria Isaac Sabba (REMAN)

an increasingly intense source of strain between plant in Amazonas State. The third is with the

Petrobras and the Brazilian government, its Grepar Participações fund for the Refinaria

majority shareholder. Lubrificantes e Derivados do Nordeste (LUB-

The NOC is entitled to set domestic prices for NOR) plant in Ceara State.

refined petroleum products in line with global Meanwhile, Petrobras has also reported that

crude oil prices; indeed, its right to do so is negotiations are underway on the sale of Refi-

enshrined in Brazil’s constitution by provisions naria Gabriel Passos (REGAP) in Minas Gerais

that give Petrobras a degree of independence State.

from the government. However, the company Petrobras’ original list of refineries slated for

has often come under pressure to uphold the privatisation also included the Refinaria do Nor-

policy goals of various presidents, and the cur- deste (RNEST) plant in Pernambuco State. The

rent holder of that office, Jair Bolsonaro, is no NOC now says, though, that it will only launch

exception. Bolsonaro has leaned on the com- a new tender for the plant after it begins work on

pany to reduce fuel prices, ostensibly to relieve a new refining unit there in 2024.

Brazilian consumers suffering from inflation but Bolsonaro is not currently favoured to win

probably also to improve his chances for re-elec- re-election in October, and his main opponent,

tion in October. Petrobras has thus far resisted, the leftist candidate and former President Luiz

however, and as such it has attracted much crit- Inácio Lula da Silva, is known to oppose the sale

icism from the president and other government of Petrobras and its assets. However, if the refin-

officials. eries can be privatised before the next president

Under these circumstances, the NOC is thus takes office in January 2023, their sale would not

eager to push forward with its privatisation plan, be challenged.

P12 www. NEWSBASE .com Week 31 03•August•2022