Page 10 - MEOG Week 16 2021

P. 10

MEOG TENDERS MEOG

Aramco launches Zuluf tenders

SAUDI ARABIA STATE-OWNED Saudi Aramco is reported to 1mn-bpd capacity increase mandated by the

have launched several tenders for the delayed Kingdom’s Ministry of Energy last year. This will

Zuluf crude increment programme that is see Aramco’s maximum sustainable capacity

expected to add 600,000 barrels per day (bpd) of (MSC) rise to 13mn bpd.

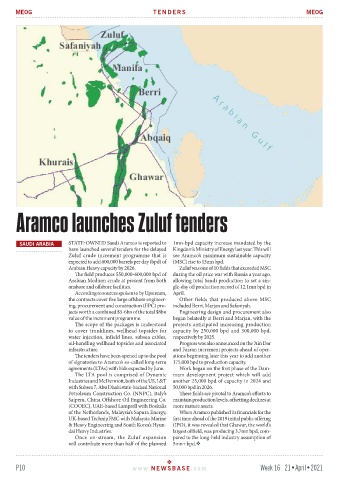

Arabian Heavy capacity by 2026. Zuluf was one of 10 fields that exceeded MSC

The field produces 550,000-600,000 bpd of during the oil price war with Russia a year ago,

Arabian Medium crude at present from both allowing total Saudi production to set a sin-

onshore and offshore facilities. gle-day oil production record of 12.1mn bpd in

According to sources spoken to by Upstream, April.

the contracts cover five large offshore engineer- Other fields that produced above MSC

ing, procurement and construction (EPC) pro- included Berri, Marjan and Safaniyah.

jects worth a combined $5-6bn of the total $8bn Engineering design and procurement also

value of the increment programme. began belatedly at Berri and Marjan, with the

The scope of the packages is understood projects anticipated increasing production

to cover trunklines, wellhead topsides for capacity by 250,000 bpd and 300,000 bpd,

water injection, infield lines, subsea cables, respectively by 2025.

oil-handling wellhead topsides and associated Progress was also announced on the ‘Ain Dar

infrastructure. and Fazran increment projects ahead of oper-

The tenders have been opened up to the pool ations beginning later this year to add another

of signatories to Aramco’s so-called long-term 175,000 bpd to production capacity.

agreements (LTAs) with bids expected by June. Work began on the first phase of the Dam-

The LTA pool is comprised of Dynamic mam development project which will add

Industries and McDermott, both of the US, L&T another 25,000 bpd of capacity in 2024 and

with Subsea 7, Abu Dhabi state-backed National 50,000 bpd in 2026.

Petroleum Construction Co. (NNPC), Italy’s These fields are pivotal to Aramco’s efforts to

Saipem, China Offshore Oil Engineering Co. maintain production levels, offsetting declines at

(COOEC), UAE-based Lamprell with Boskalis more mature assets.

of the Netherlands, Malaysia’s Sapura Energy, When Aramco published its financials for the

UK-based TechnipFMC with Malaysia Marine first time ahead of the 2019 initial public offering

& Heavy Engineering and South Korea’s Hyun- (IPO), it was revealed that Ghawar, the world’s

dai Heavy Industries. largest oilfield, was producing 3.7mn bpd, com-

Once on-stream, the Zuluf expansion pared to the long-held industry assumption of

will contribute more than half of the planned 5mn+ bpd.

P10 www. NEWSBASE .com Week 16 21•April•2021