Page 76 - Winning The Credit Game Bundle (CK Patrick)

P. 76

64 THE CREDIT GAME

will know that you are aware of the legal remedies available to you if

they genuinely have made a mistake and they fail to correct it.

Knowing that you are aware that you may be able to sue them over

such a mistake gives them incentive to investigate and correct the

error.

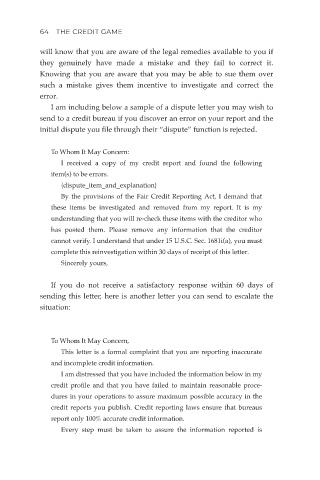

I am including below a sample of a dispute letter you may wish to

send to a credit bureau if you discover an error on your report and the

initial dispute you file through their “dispute” function is rejected.

To Whom It May Concern:

I received a copy of my credit report and found the following

item(s) to be errors.

{dispute_item_and_explanation}

By the provisions of the Fair Credit Reporting Act, I demand that

these items be investigated and removed from my report. It is my

understanding that you will re-check these items with the creditor who

has posted them. Please remove any information that the creditor

cannot verify. I understand that under 15 U.S.C. Sec. 1681i(a), you must

complete this reinvestigation within 30 days of receipt of this letter.

Sincerely yours,

If you do not receive a satisfactory response within 60 days of

sending this letter, here is another letter you can send to escalate the

situation:

To Whom It May Concern,

This letter is a formal complaint that you are reporting inaccurate

and incomplete credit information.

I am distressed that you have included the information below in my

credit profile and that you have failed to maintain reasonable proce-

dures in your operations to assure maximum possible accuracy in the

credit reports you publish. Credit reporting laws ensure that bureaus

report only 100% accurate credit information.

Every step must be taken to assure the information reported is