Page 80 - draft

P. 80

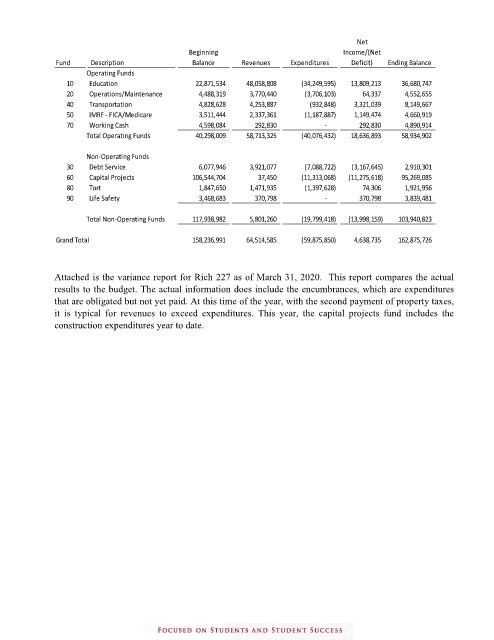

Net

Beginning Income/(Net

Fund Description Balance Revenues Expenditures Deficit) Ending Balance

Operating Funds

10 Education 22,871,534 48,058,808 (34,249,595) 13,809,213 36,680,747

20 Operations/Maintenance 4,488,319 3,770,440 (3,706,103) 64,337 4,552,655

40 Transportation 4,828,628 4,253,887 (932,848) 3,321,039 8,149,667

50 IMRF - FICA/Medicare 3,511,444 2,337,361 (1,187,887) 1,149,474 4,660,919

70 Working Cash 4,598,084 292,830 - 292,830 4,890,914

Total Operating Funds 40,298,009 58,713,325 (40,076,432) 18,636,893 58,934,902

Non-Operating Funds

30 Debt Service 6,077,946 3,921,077 (7,088,722) (3,167,645) 2,910,301

60 Capital Projects 106,544,704 37,450 (11,313,068) (11,275,618) 95,269,085

80 Tort 1,847,650 1,471,935 (1,397,628) 74,306 1,921,956

90 Life Safety 3,468,683 370,798 - 370,798 3,839,481

Total Non-Operating Funds 117,938,982 5,801,260 (19,799,418) (13,998,159) 103,940,823

Grand Total 158,236,991 64,514,585 (59,875,850) 4,638,735 162,875,726

Attached is the variance report for Rich 227 as of March 31, 2020. This report compares the actual

results to the budget. The actual information does include the encumbrances, which are expenditures

that are obligated but not yet paid. At this time of the year, with the second payment of property taxes,

it is typical for revenues to exceed expenditures. This year, the capital projects fund includes the

construction expenditures year to date.