Page 713 - Accounting Principles (A Business Perspective)

P. 713

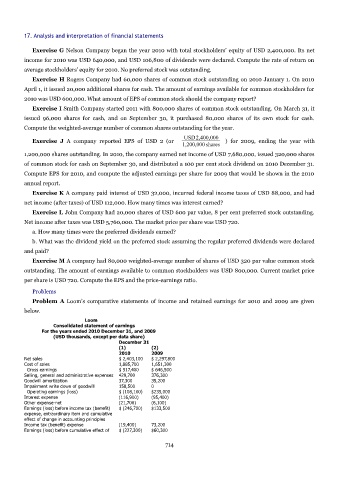

17. Analysis and interpretation of financial statements

Exercise G Nelson Company began the year 2010 with total stockholders' equity of USD 2,400,000. Its net

income for 2010 was USD 640,000, and USD 106,800 of dividends were declared. Compute the rate of return on

average stockholders' equity for 2010. No preferred stock was outstanding.

Exercise H Rogers Company had 60,000 shares of common stock outstanding on 2010 January 1. On 2010

April 1, it issued 20,000 additional shares for cash. The amount of earnings available for common stockholders for

2010 was USD 600,000. What amount of EPS of common stock should the company report?

Exercise I Smith Company started 2011 with 800,000 shares of common stock outstanding. On March 31, it

issued 96,000 shares for cash, and on September 30, it purchased 80,000 shares of its own stock for cash.

Compute the weighted-average number of common shares outstanding for the year.

USD2,400,000

Exercise J A company reported EPS of USD 2 (or ) for 2009, ending the year with

1,200,000 shares

1,200,000 shares outstanding. In 2010, the company earned net income of USD 7,680,000, issued 320,000 shares

of common stock for cash on September 30, and distributed a 100 per cent stock dividend on 2010 December 31.

Compute EPS for 2010, and compute the adjusted earnings per share for 2009 that would be shown in the 2010

annual report.

Exercise K A company paid interest of USD 32,000, incurred federal income taxes of USD 88,000, and had

net income (after taxes) of USD 112,000. How many times was interest earned?

Exercise L John Company had 20,000 shares of USD 600 par value, 8 per cent preferred stock outstanding.

Net income after taxes was USD 5,760,000. The market price per share was USD 720.

a. How many times were the preferred dividends earned?

b. What was the dividend yield on the preferred stock assuming the regular preferred dividends were declared

and paid?

Exercise M A company had 80,000 weighted-average number of shares of USD 320 par value common stock

outstanding. The amount of earnings available to common stockholders was USD 800,000. Current market price

per share is USD 720. Compute the EPS and the price-earnings ratio.

Problems

Problem A Loom's comparative statements of income and retained earnings for 2010 and 2009 are given

below.

Loom

Consolidated statement of earnings

For the years ended 2010 December 31, and 2009

(USD thousands, except per data share)

December 31

(1) (2)

2010 2009

Net sales $ 2,403,100 $ 2,297,800

Cost of sales 1,885,700 1,651,300

Gross earnings $ 517,400 $ 646,500

Selling, general and administrative expenses 429,700 376,300

Goodwill amortization 37,300 35,200

Impairment write down of goodwill 158,500 0

Operating earnings (loss) $ (108,100) $235,000

Interest expense (116,900) (95,400)

Other expense-net (21,700) (6,100)

Earnings (loss) before income tax (benefit) $ (246,700) $133,500

expense, extraordinary item and cumulative

effect of change in accounting principles

Income tax (benefit) expense (19,400) 73,200

Earnings (loss) before cumulative effect of $ (227,300) $60,300

714