Page 708 - Accounting Principles (A Business Perspective)

P. 708

This book is licensed under a Creative Commons Attribution 3.0 License

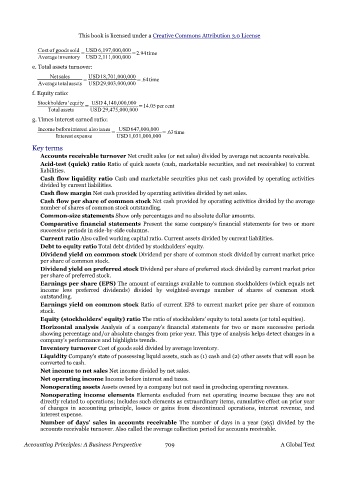

Cost of goods sold USD 6,197,000,000 =2.94time

Average inventory = USD 2,111,000,000

e. Total assets turnover:

Netsales USD18,701,000,000 =.64time

Average totalassets = USD29,003,000,000

f. Equity ratio:

Stockholders'equity = USD 4,140,000,000 =14.05 per cent

Total assets USD 29,475,000,000

g. Times interest earned ratio:

Income beforeinterest alsotaxes = USD647,000,000 =.63time

Interest expense USD1,031,000,000

Key terms

Accounts receivable turnover Net credit sales (or net sales) divided by average net accounts receivable.

Acid-test (quick) ratio Ratio of quick assets (cash, marketable securities, and net receivables) to current

liabilities.

Cash flow liquidity ratio Cash and marketable securities plus net cash provided by operating activities

divided by current liabilities.

Cash flow margin Net cash provided by operating activities divided by net sales.

Cash flow per share of common stock Net cash provided by operating activities divided by the average

number of shares of common stock outstanding.

Common-size statements Show only percentages and no absolute dollar amounts.

Comparative financial statements Present the same company's financial statements for two or more

successive periods in side-by-side columns.

Current ratio Also called working capital ratio. Current assets divided by current liabilities.

Debt to equity ratio Total debt divided by stockholders' equity.

Dividend yield on common stock Dividend per share of common stock divided by current market price

per share of common stock.

Dividend yield on preferred stock Dividend per share of preferred stock divided by current market price

per share of preferred stock.

Earnings per share (EPS) The amount of earnings available to common stockholders (which equals net

income less preferred dividends) divided by weighted-average number of shares of common stock

outstanding.

Earnings yield on common stock Ratio of current EPS to current market price per share of common

stock.

Equity (stockholders' equity) ratio The ratio of stockholders' equity to total assets (or total equities).

Horizontal analysis Analysis of a company's financial statements for two or more successive periods

showing percentage and/or absolute changes from prior year. This type of analysis helps detect changes in a

company's performance and highlights trends.

Inventory turnover Cost of goods sold divided by average inventory.

Liquidity Company's state of possessing liquid assets, such as (1) cash and (2) other assets that will soon be

converted to cash.

Net income to net sales Net income divided by net sales.

Net operating income Income before interest and taxes.

Nonoperating assets Assets owned by a company but not used in producing operating revenues.

Nonoperating income elements Elements excluded from net operating income because they are not

directly related to operations; includes such elements as extraordinary items, cumulative effect on prior year

of changes in accounting principle, losses or gains from discontinued operations, interest revenue, and

interest expense.

Number of days' sales in accounts receivable The number of days in a year (365) divided by the

accounts receivable turnover. Also called the average collection period for accounts receivable.

Accounting Principles: A Business Perspective 709 A Global Text