Page 709 - Accounting Principles (A Business Perspective)

P. 709

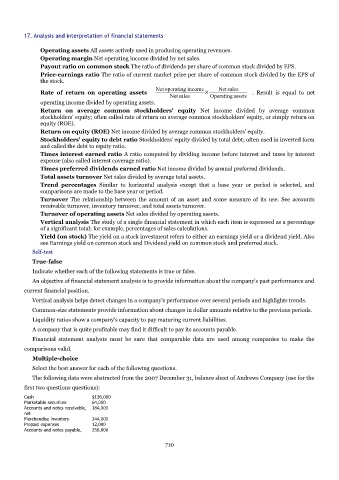

17. Analysis and interpretation of financial statements

Operating assets All assets actively used in producing operating revenues.

Operating margin Net operating income divided by net sales.

Payout ratio on common stock The ratio of dividends per share of common stock divided by EPS.

Price-earnings ratio The ratio of current market price per share of common stock divided by the EPS of

the stock.

Netoperating income Netsales

Rate of return on operating assets × . Result is equal to net

Netsales Operatingassets

operating income divided by operating assets.

Return on average common stockholders' equity Net income divided by average common

stockholders' equity; often called rate of return on average common stockholders' equity, or simply return on

equity (ROE).

Return on equity (ROE) Net income divided by average common stockholders' equity.

Stockholders' equity to debt ratio Stockholders' equity divided by total debt; often used in inverted form

and called the debt to equity ratio.

Times interest earned ratio A ratio computed by dividing income before interest and taxes by interest

expense (also called interest coverage ratio).

Times preferred dividends earned ratio Net income divided by annual preferred dividends.

Total assets turnover Net sales divided by average total assets.

Trend percentages Similar to horizontal analysis except that a base year or period is selected, and

comparisons are made to the base year or period.

Turnover The relationship between the amount of an asset and some measure of its use. See accounts

receivable turnover, inventory turnover, and total assets turnover.

Turnover of operating assets Net sales divided by operating assets.

Vertical analysis The study of a single financial statement in which each item is expressed as a percentage

of a significant total; for example, percentages of sales calculations.

Yield (on stock) The yield on a stock investment refers to either an earnings yield or a dividend yield. Also

see Earnings yield on common stock and Dividend yield on common stock and preferred stock.

Self-test

True-false

Indicate whether each of the following statements is true or false.

An objective of financial statement analysis is to provide information about the company's past performance and

current financial position.

Vertical analysis helps detect changes in a company's performance over several periods and highlights trends.

Common-size statements provide information about changes in dollar amounts relative to the previous periods.

Liquidity ratios show a company's capacity to pay maturing current liabilities.

A company that is quite profitable may find it difficult to pay its accounts payable.

Financial statement analysts must be sure that comparable data are used among companies to make the

comparisons valid.

Multiple-choice

Select the best answer for each of the following questions.

The following data were abstracted from the 2007 December 31, balance sheet of Andrews Company (use for the

first two questions questions):

Cash $136,000

Marketable securities 64,000

Accounts and notes receivable, 184,000

net

Merchandise inventory 244,000

Prepaid expenses 12,000

Accounts and notes payable, 256,000

710