Page 16 - NOLASky_OfferingMemorandum_GSP

P. 16

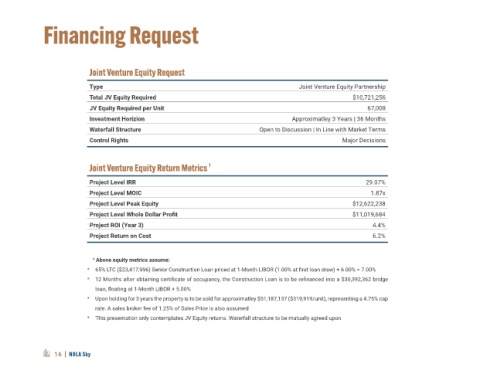

Financing Request

Joint Venture Equity Request

Type Joint Venture Equity Partnership

Total JV Equity Required $10,721,256

JV Equity Required per Unit 67,008

Investment Horizion Approximatley 3 Years | 36 Months

Waterfall Structure Open to Discussion | In Line with Market Terms

Control Rights Major Decisions

Joint Venture Equity Return Metrics 1

Project Level IRR 29.07%

Project Level MOIC 1.87x

Project Level Peak Equity $12,622,238

Project Level Whole Dollar Profit $11,019,684

Project ROI (Year 3) 4.4%

Project Return on Cost 6.2%

¹ Above equity metrics assume:

• 65% LTC ($23,417,996) Senior Construction Loan priced at 1-Month LIBOR (1.00% at first loan draw) + 6.00% = 7.00%

• 12 Months after obtaining certificate of occupancy, the Construction Loan is to be refinanced into a $30,392,362 bridge

loan, floating at 1-Month LIBOR + 5.00%

• Upon holding for 3 years the property is to be sold for approximatley $51,187,137 ($319,919/unit), representing a 4.75% cap

rate. A sales broker fee of 1.25% of Sales Price is also assumed

• This presentation only contemplates JV Equity returns. Waterfall structure to be mutually agreed upon

16 | NOLA Sky