Page 18 - NOLASky_OfferingMemorandum_GSP

P. 18

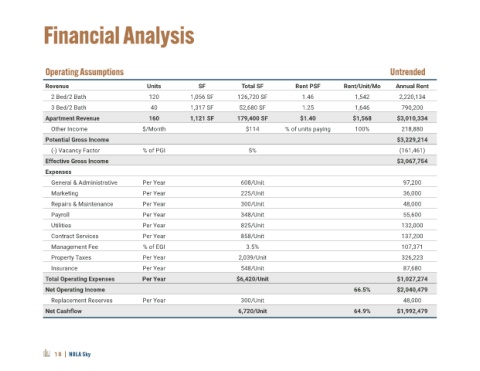

Financial Analysis

Operating Assumptions Untrended

Revenue Units SF Total SF Rent PSF Rent/Unit/Mo Annual Rent

2 Bed/2 Bath 120 1,056 SF 126,720 SF 1.46 1,542 2,220,134

3 Bed/2 Bath 40 1,317 SF 52,680 SF 1.25 1,646 790,200

Apartment Revenue 160 1,121 SF 179,400 SF $1.40 $1,568 $3,010,334

Other Income $/Month $114 % of units paying 100% 218,880

Potential Gross Income $3,229,214

(-) Vacancy Factor % of PGI 5% (161,461)

Effective Gross Income $3,067,754

Expenses

General & Administrative Per Year 608/Unit 97,200

Marketing Per Year 225/Unit 36,000

Repairs & Maintenance Per Year 300/Unit 48,000

Payroll Per Year 348/Unit 55,600

Utilities Per Year 825/Unit 132,000

Contract Services Per Year 858/Unit 137,200

Management Fee % of EGI 3.5% 107,371

Property Taxes Per Year 2,039/Unit 326,223

Insurance Per Year 548/Unit 87,680

Total Operating Expenses Per Year $6,420/Unit $1,027,274

Net Operating Income 66.5% $2,040,479

Replacement Reserves Per Year 300/Unit 48,000

Net Cashflow 6,720/Unit 64.9% $1,992,479

18 | NOLA Sky